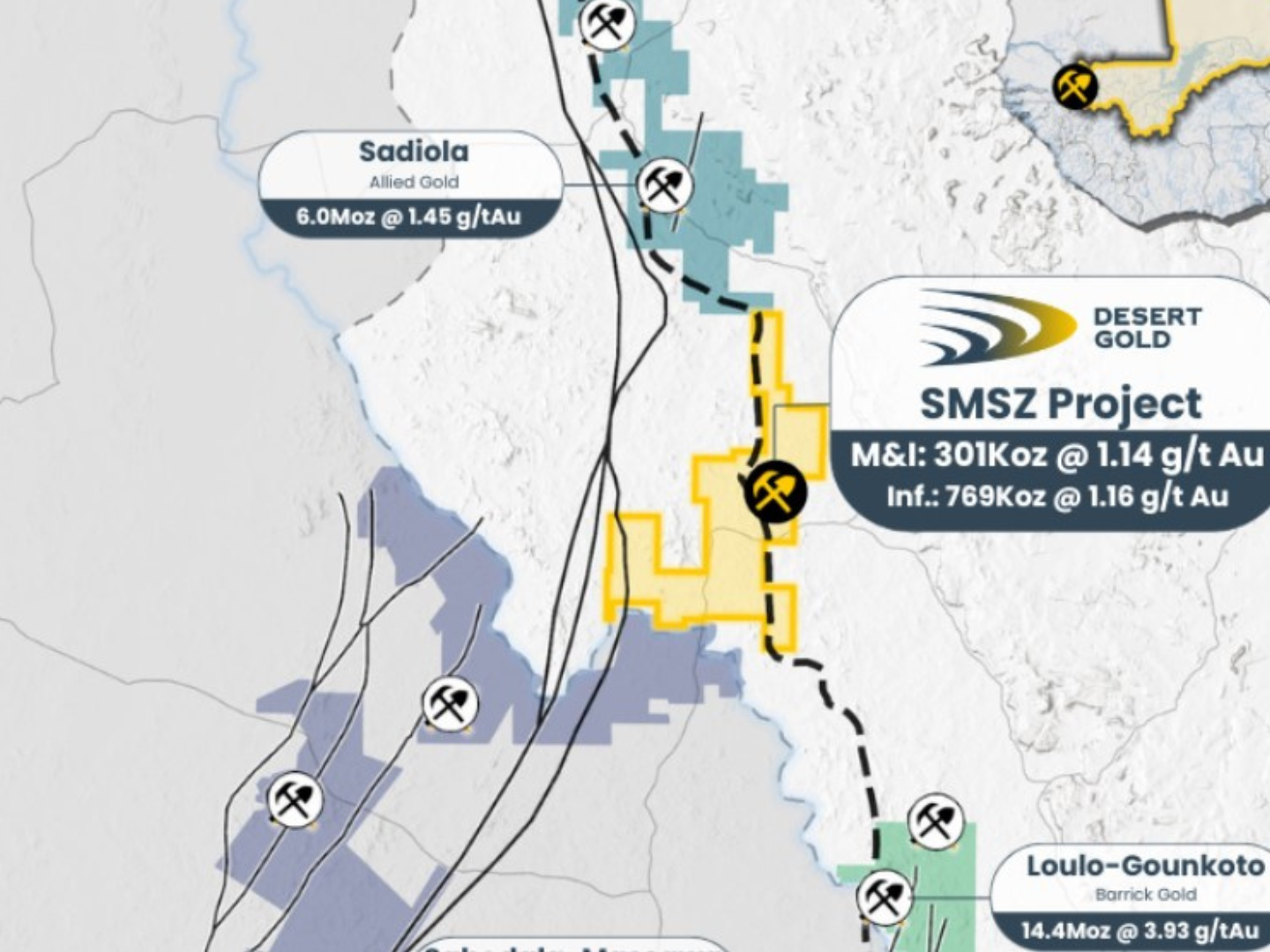

Gold exploration and development company Desert Gold Ventures’ preliminary economic assessment (PEA) for the Barani and Gourbassi deposits, located on its 100%-owned SMSZ gold project in western Mali outlines a low-capex, open-pit oxide mining operation, with projected production of approximately 18,300 t/month over a mine life exceeding 17 years.

The technical work and cost estimation of the study exceeded the minimum standards typically required for a PEA and was completed to a confidence level of ±25% accuracy. The PEA mine plan includes a total of 113,500 oz of gold contained, with an estimated 97,600 oz expected to be recovered through a simple, gravity and CIL processing flowsheet, based on an average metallurgical recovery of 86%.

ALSO READ: West African’s Burkina Faso operations produce gold

At a spot gold price of USD $2,500/oz, the project generates an after-tax net present value (NPV) at a 10% discount rate of USD $24 million, an internal rate of return (IRR) of 34%, and a projected payback period of 3.25 years. At the current spot gold price of USD $3,366 the project generates an after-tax NPV at a 10% discount rate of USD $54 million, an IRR of 64%, and a projected payback period of 2.5 years.

The mining plan is designed to be broken out into two phases, starting with open-pit operations at Barani East before transitioning to the Gourbassi deposits. A modular gravity and CIL processing plant will be commissioned at Barani for the first phase of production and later moved to Gourbassi as operations shift. This staged approach helps keep initial capital costs low, avoids duplicating infrastructure, and allows the company to unlock value from multiple oxide gold zones across the SMSZ project in a flexible and cost-effective manner.