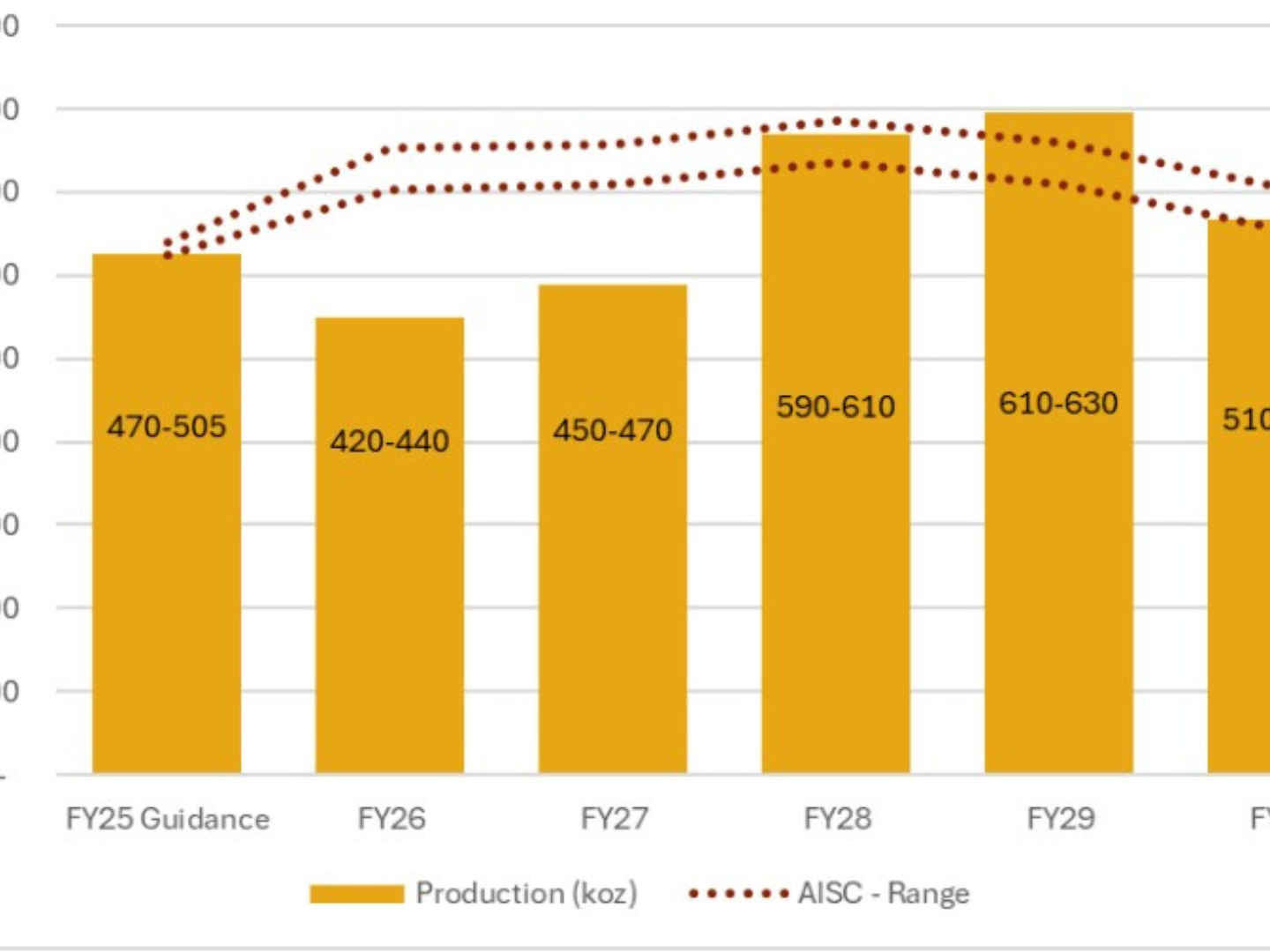

Australian gold mining company Perseus Mining Limited’s gold production and All-In Site Cost (AISC) outlook for the five-year period from FY26 to FY30 inclusive for its portfolio of mines located in Ghana, Côte d’Ivoire and Tanzania has delivered on its strategy of building a sustainable, geopolitically diversified, Africa-focused gold business.

The five-year operating outlook incorporates the updated planning outlook for each of the company’s three existing operations based on planning assumptions reflecting current operating conditions. It also takes into account final investment decisions for the CMA underground mining operation at the Yaouré gold mine in Côte d’Ivoire.

ALSO READ:

Sanu Gold extends mineralisation, makes discoveries in Guinea

The business incorporates three to four operating mines that produce between 500koz to 600koz of gold per annum at a cash margin of not less than US$500/oz. As part of its annual planning cycle, Perseus has reassessed the growth opportunities available within its portfolio with the approach of optimising it rather than focusing on fixed investment targets for each asset. In this way, the company has sought to find the balance between investment in growth opportunities and the cash margin generated by the business.

Average gold production for the group over the five-year period is 515koz – 535koz per annum for a total of 2.6Moz – 2.7Moz with Yaouré contributing 34%, Edikan contributing 28% and Sissingué contributing 10%. Based on the current schedule, the recently committed NGP in Tanzania is anticipated to provide 28% of the metal production for the portfolio over the next five years.

ALSO READ:

Aurum hits 34m at 2.32 g/t gold from 56m at Boundiali’s BD tenement

The weighted average AISC over the five-year outlook is estimated at US$1,400/oz – US$1,500/oz. AISC rises slightly in the first two years, driven by a lower production base. In FY28, the integration of lower-margin ore sources into the mine plan contributes to a slight increase in AISC. The portfolio’s diverse production base allows AISC to remain within ±10% of the five-year average on a year-to-year basis.

CEO and managing director, Jeff Quartermaine says: “From the five-year outlook published today, it is clear that Perseus’s strategy of consistently producing between 500,000 to 600,0000 ounces of gold per year at a cash margin of not less than US$500 per ounce, is eminently achievable. With cash and undrawn debt capacity currently exceeding US$1.1 billion, Perseus is fully funded to not only deliver the five-year outlook as presented today but also consider a prudent mix of future growth opportunities beyond the current plan, as well as generous returns to shareholders”.