Small cap stocks historically have had very strong growth rates that have allowed rapid market appreciation as new services and technologies appear in the marketplace.

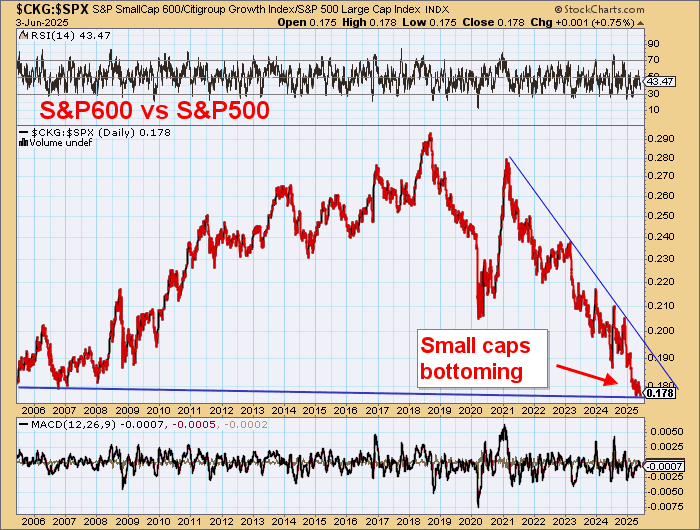

The small cap indices like the Russell 2000 and the S&P600 had significantly outperformed the broad market indices after the global financial crisis (GFC) in 2008/09, but took a dive after the Biden Administration held back some sectors and hindered a lot of M&A through tighter shareholder regulations.

From late 2021 these small cap indices declined by around 35%.

These small caps should now start to run higher and good gains might be made.

The Russell 2000 had a sharp fall in April but is now recovering and appears to be doing the right hand shoulder of a H&S reversal pattern that should drive it to a new high.

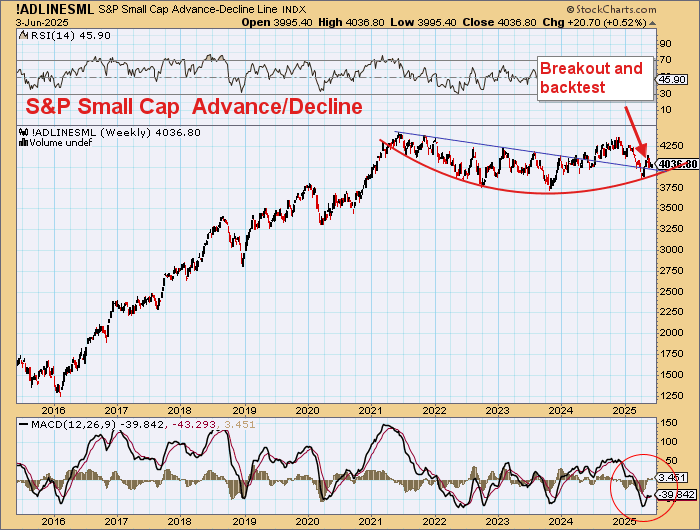

The Advance/Decline index is simply a sum of those stocks rising less the number falling and this index has travelled sideways now for almost four years.

This is an accumulation pattern and it appears to be ready to move up quite strongly.

What is good for small caps in the U.S. (i.e., large caps by Australian standards) will be good for small caps everywhere.

As has been noted here continually, the ASX indices run by S&P do not serve our markets very well.

The Small Cap Resources index for example has numerous +A$billion companies so has no meaning in our context.

I am still fighting with S&P to remove bauxite stock CAY from the ASX XGD Gold Index as I also had to get lithium stock Iris Metals removed a couple of years ago.

I have made comments about Moody’s and S&P ratings services so their performances here haven’t been too flash.

The CDNX Composite Index is the best global index to follow even though it is not just resources companies.

Making new 3-year highs

Completing 17-year bear market with an H&S reversal pattern

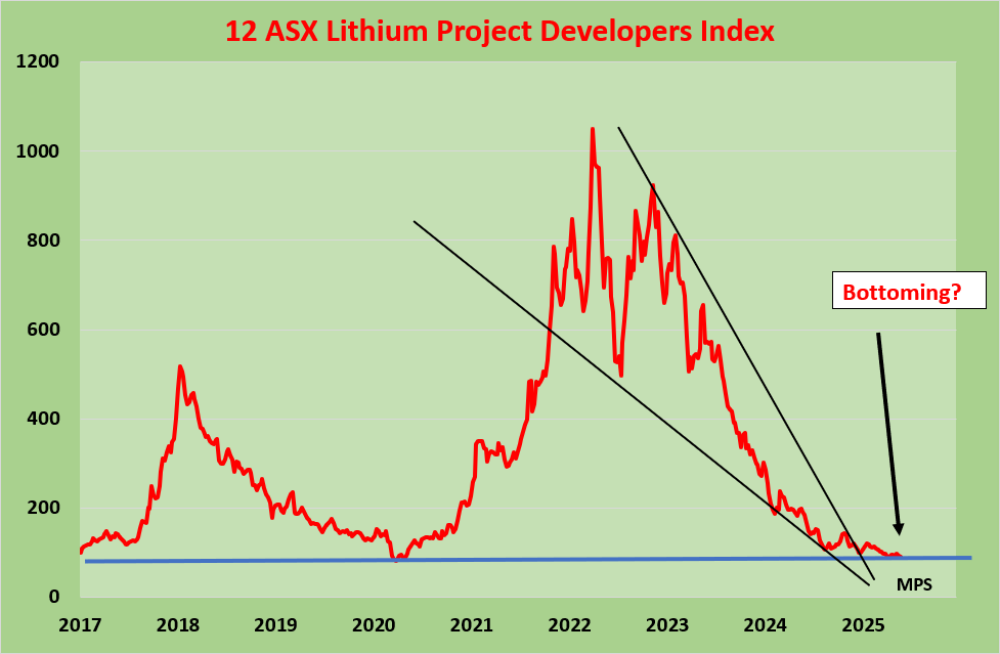

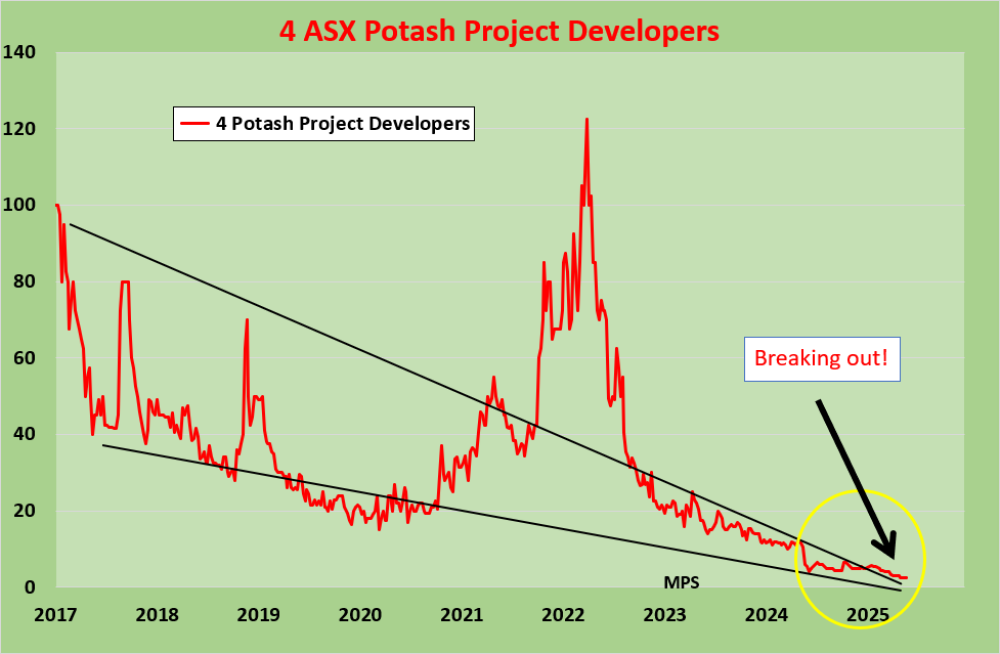

ASX small resources companies sectors we follow:

All these sectors are bottoming.

Gold is obviously leading but the rest are only just starting to move higher.

Uranium is a bit different.

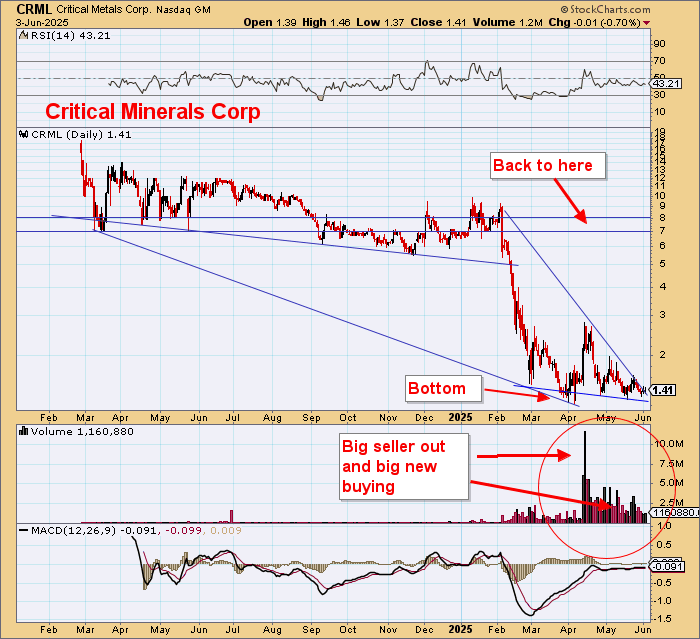

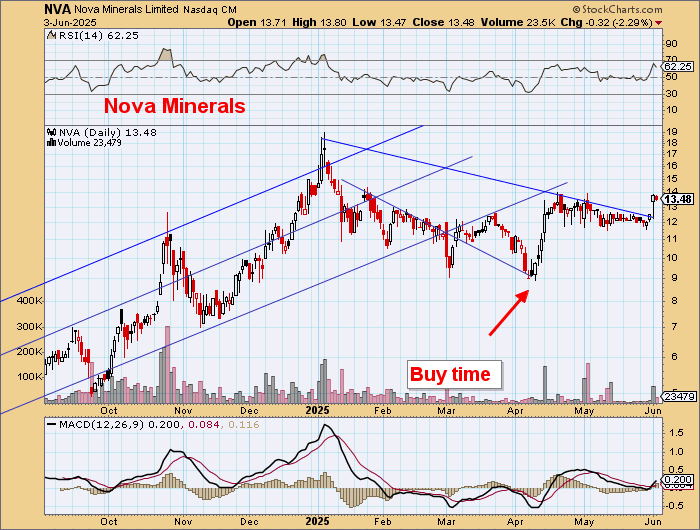

Small caps I like:

Nth American ASX stocks

EUR owns ~70% of this.

Ready to blast off soon.

WMG has 5 mt of contained nickel, and the nickel price ready to move higher.

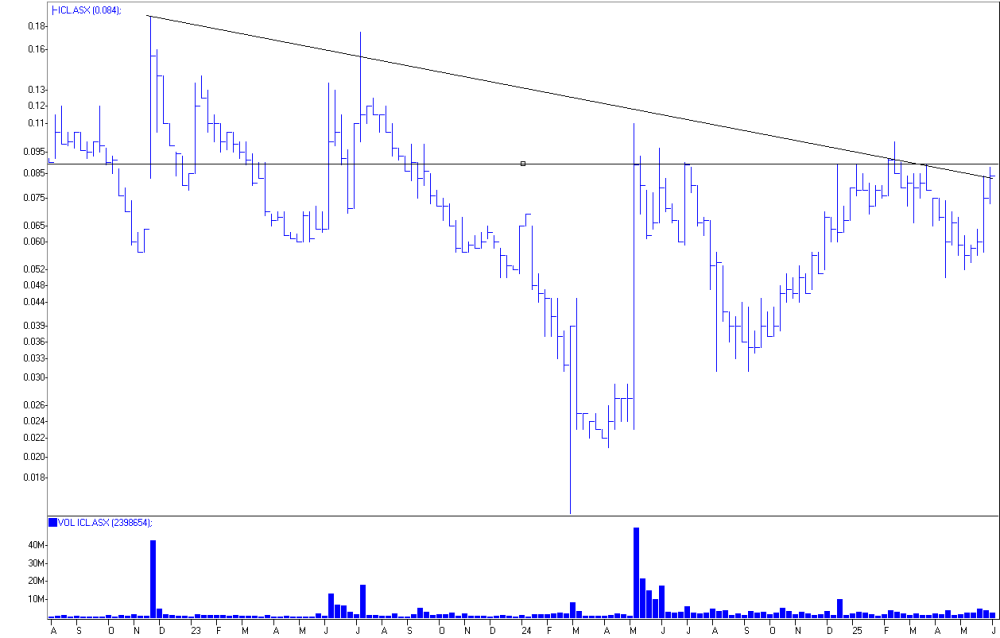

Iceni ICL has a big gold discovery coming up.

Siren Gold holds 14 million RUA shares.

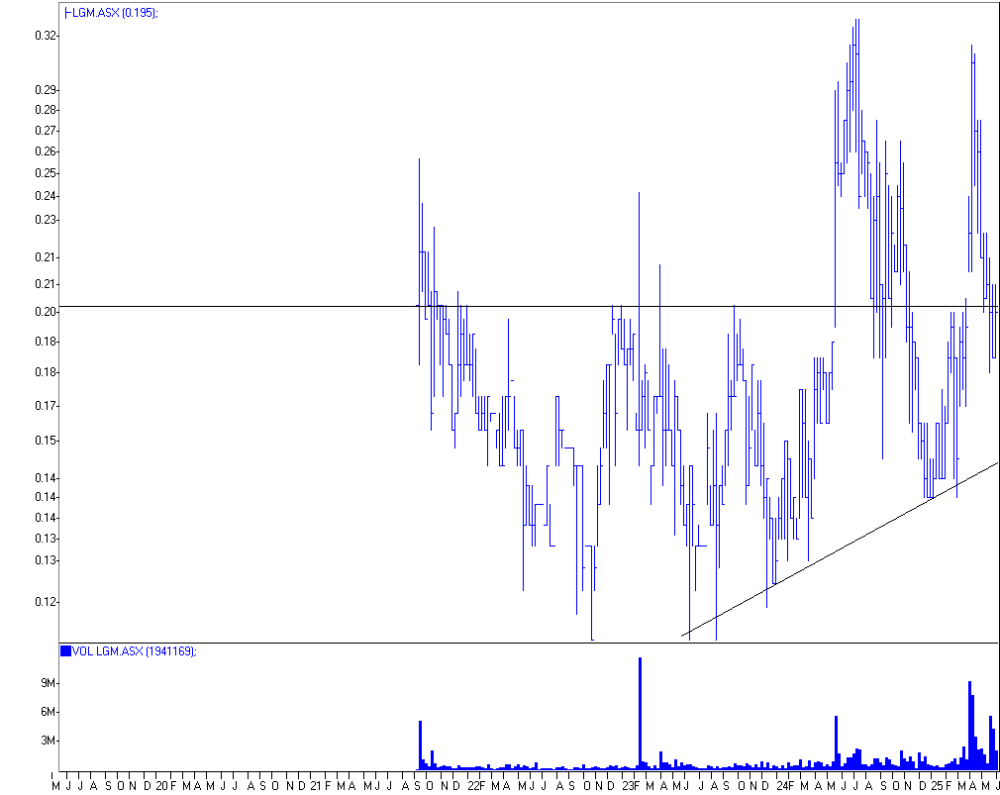

LGM Legacy explorer in NSW.

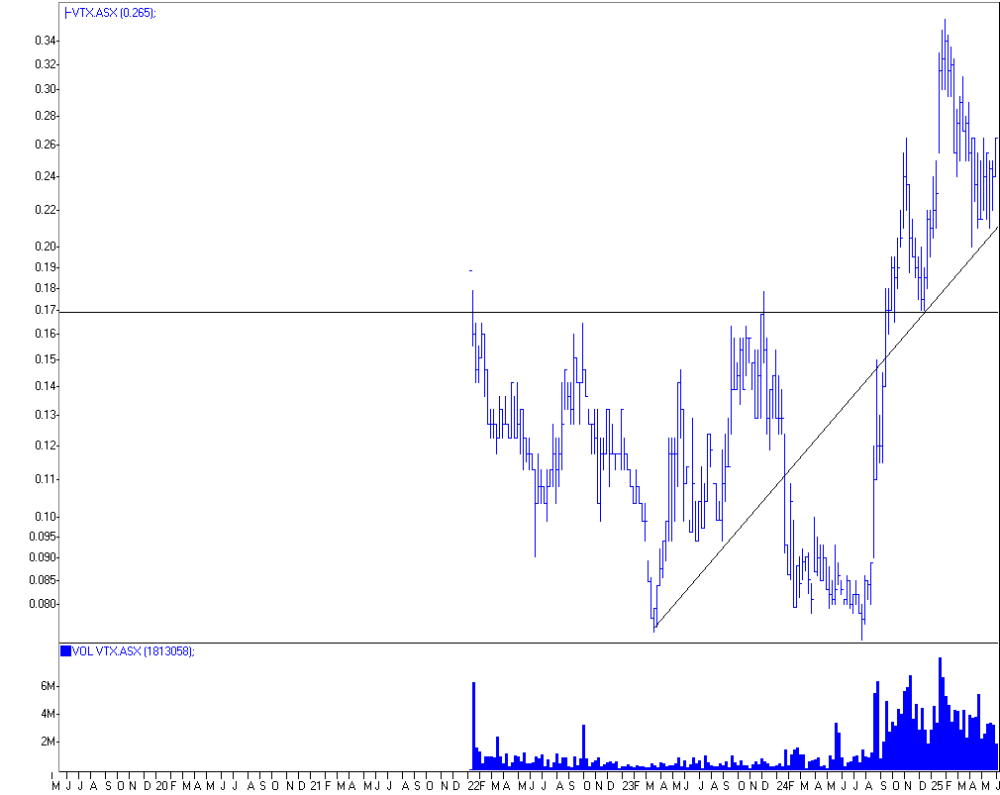

VTX, an emerging high-grade gold producer.

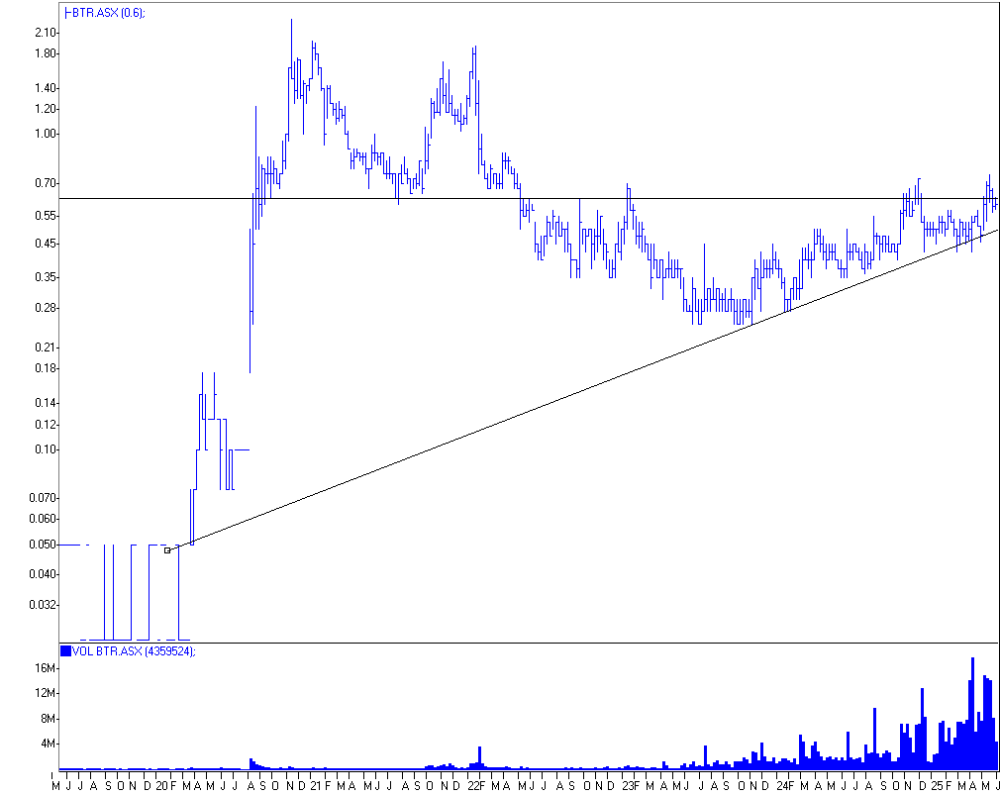

Emerging WA gold producer.

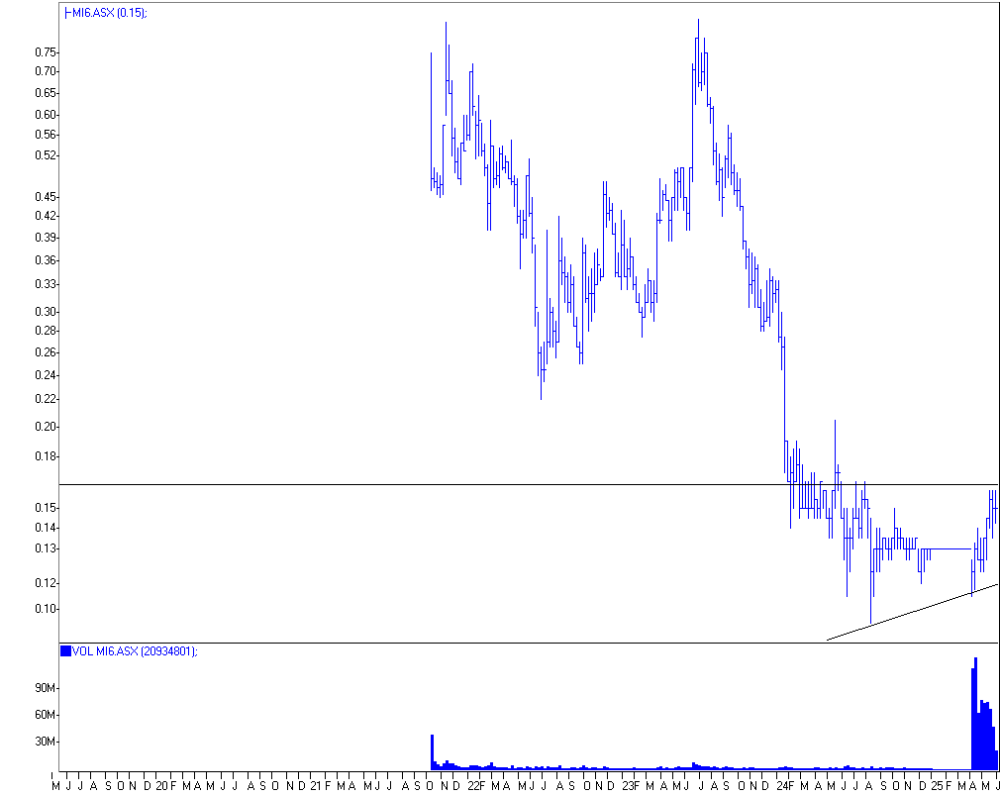

MI6 Developing Bullabulling.

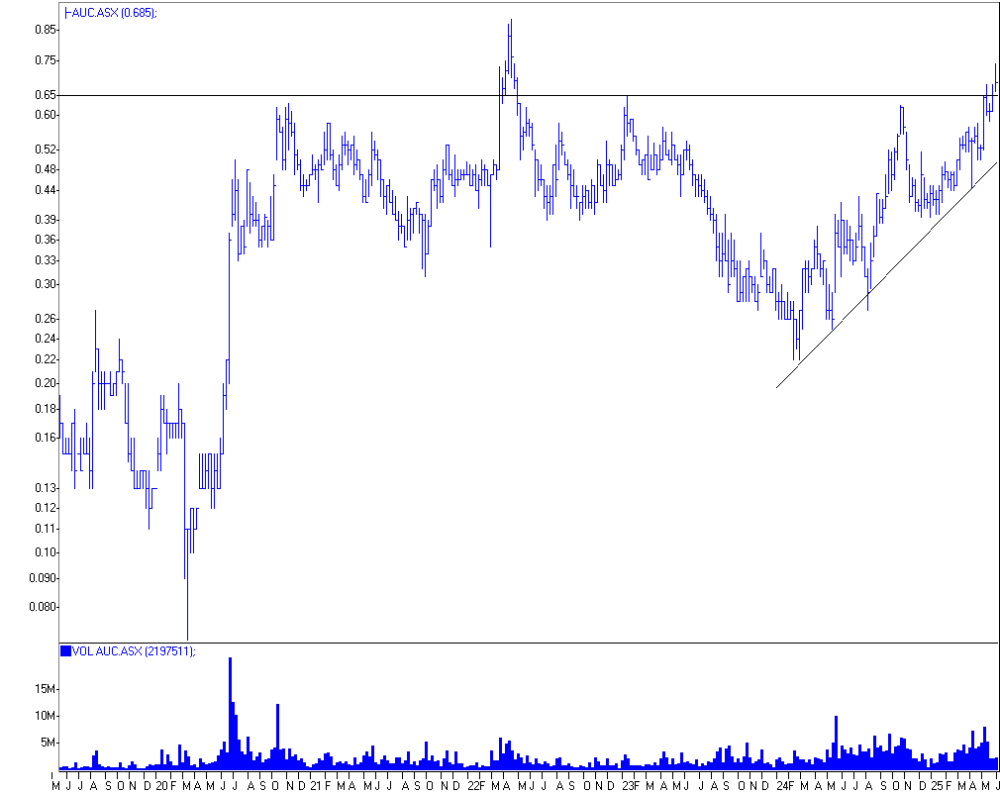

AUC

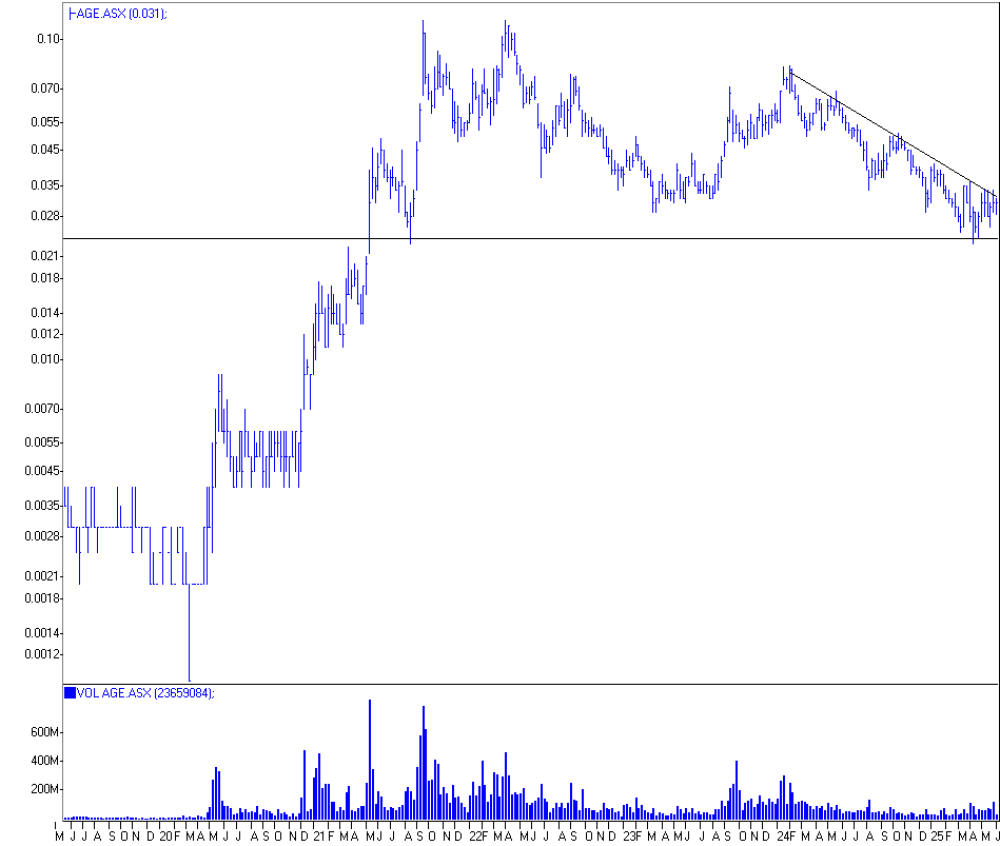

AGE Uranium in Sth Aust

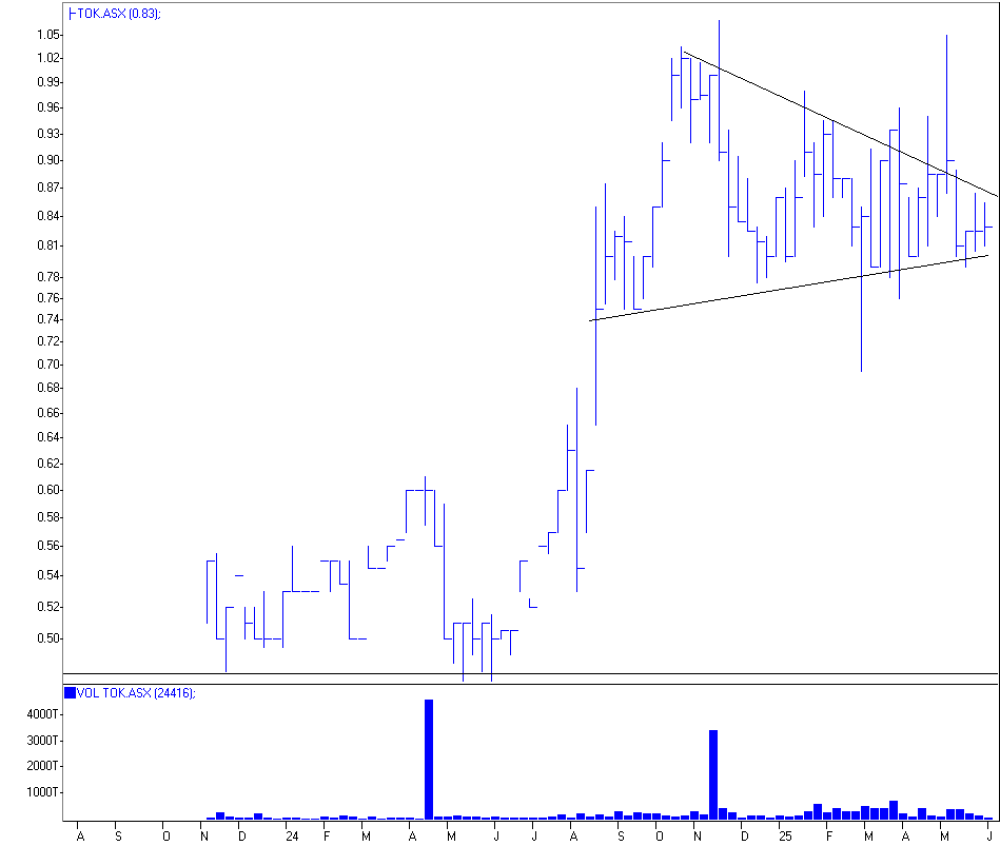

TOK

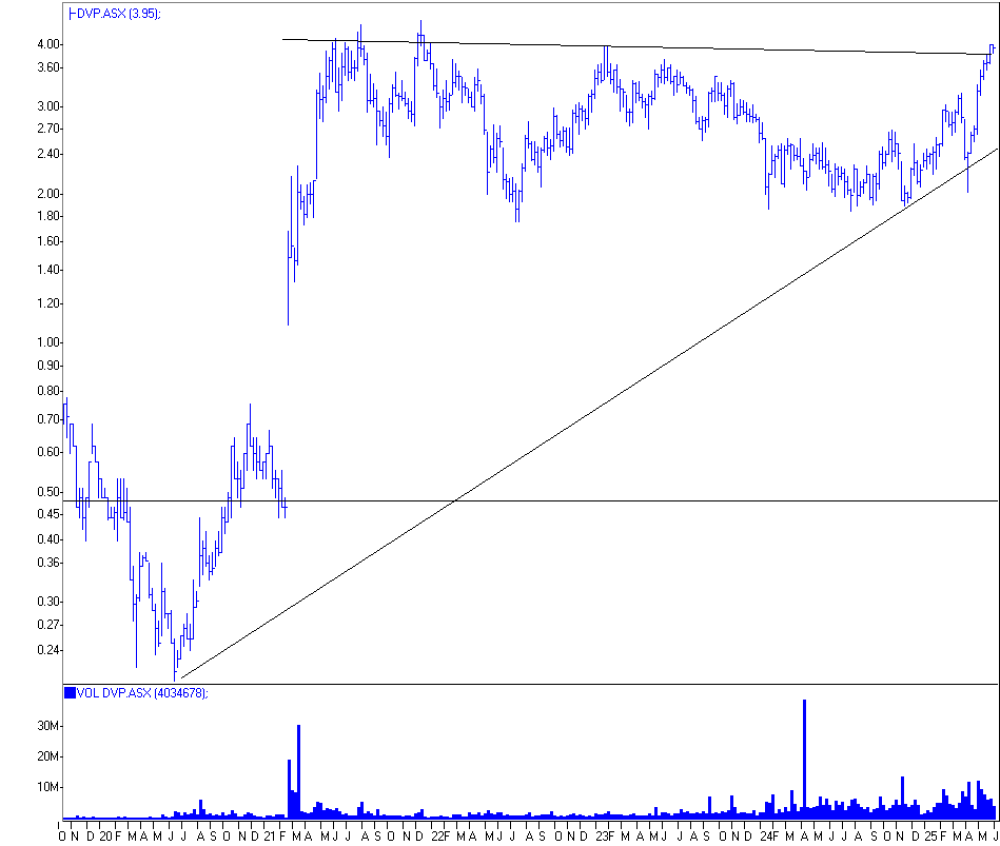

DVP

| Want to be the first to know about interesting Base Metals, PGM – Platinum Group Metals, Battery Metals, Gold and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |