Southern Africa focused metals exploration and gold production company Kavango Resources has exercised its option to acquire 100% of the Nara gold project in Zimbabwe. To fund the acquisition and provide working capital for development, Kavango has received a written commitment from finance company Purebond Limited to subscribe for the equivalent of US$5million worth of new ordinary shares in the company at 1p per share, with the subscription expected to form part of the fundraise associated with the company’s forthcoming listing on the Victoria Falls Stock Exchange.

Kavango intends to release its technical and commercial appraisal of Nara in the coming month. The company entered the option to acquire Nara in June 2023 and is exploring for gold deposits in Zimbabwe that have the potential to be developed into commercial scale production quickly through modern mechanised mining and processing, targeting both open-pit and underground opportunities.

ALSO READ: Cobre commences diamond drilling at Okavango in Botswana

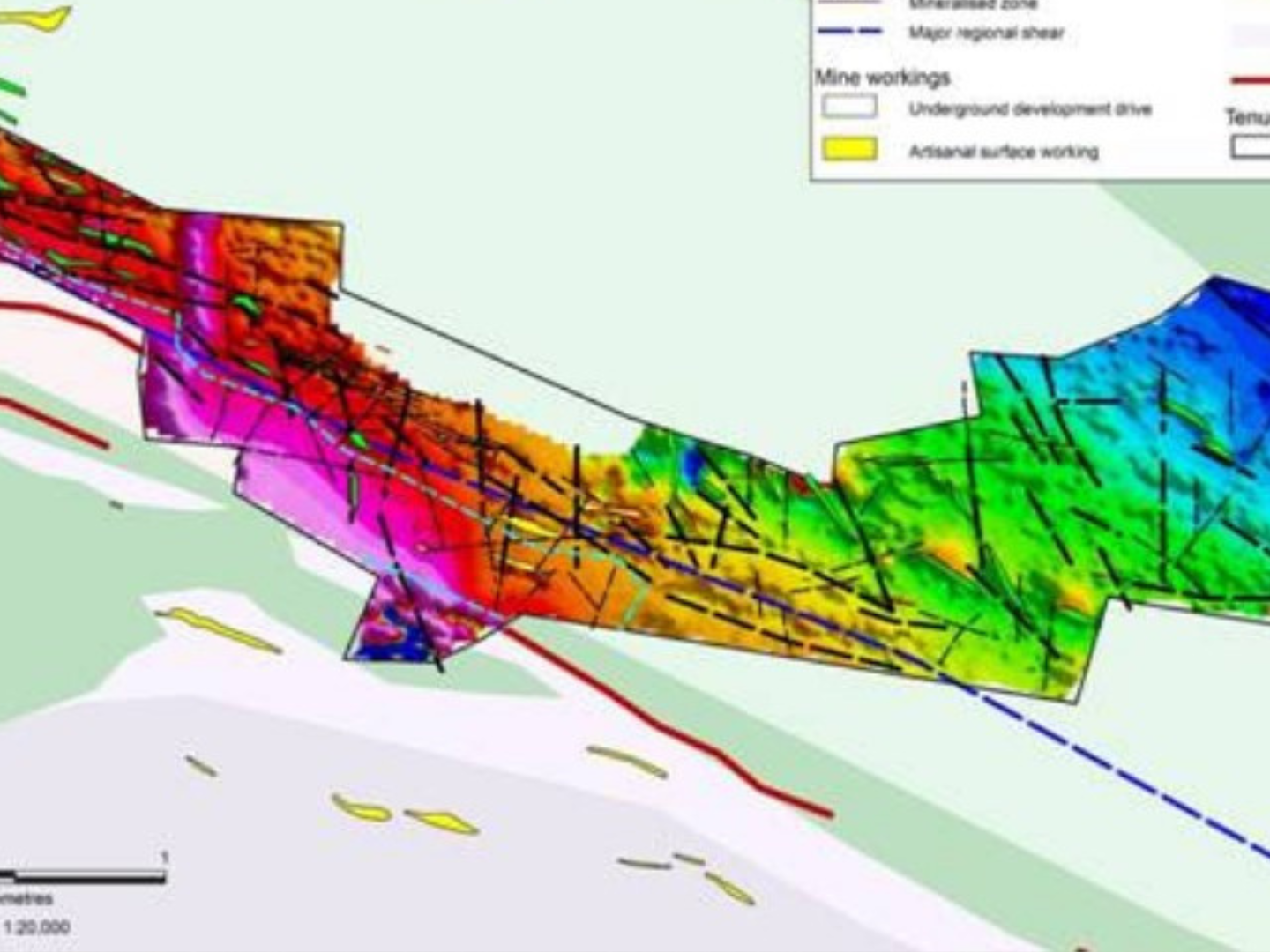

The company is exploring for a large-scale, mechanisable underground gold deposit. The primary target zone is around the historic N1 mine, where it is assessing the potential to expand artisanal workings both at depth and along strike.

Ben Turney, Kavango chief executive officer comments: “Once we have completed the Nara acquisition, Kavango will own 100pc of two significant gold mining projects in the Filabusi Greenstone Belt. Both projects are fully permitted mining leases that are held in perpetuity by production. This puts Kavango in a strong position to generate free-cash flow over the long-term. Thanks to Purebond’s support, we have built our business through equity investment and have no debt. Our debt-to-equity ratio is zero and our hope is shareholders will enjoy good returns over the coming years.