Day two of the DRC Mining Week 2025 kicked off with a clear message: the Democratic Republic of Congo (DRC) is not just a mineral-rich country—it is fast solidifying its position as a global mining leader.

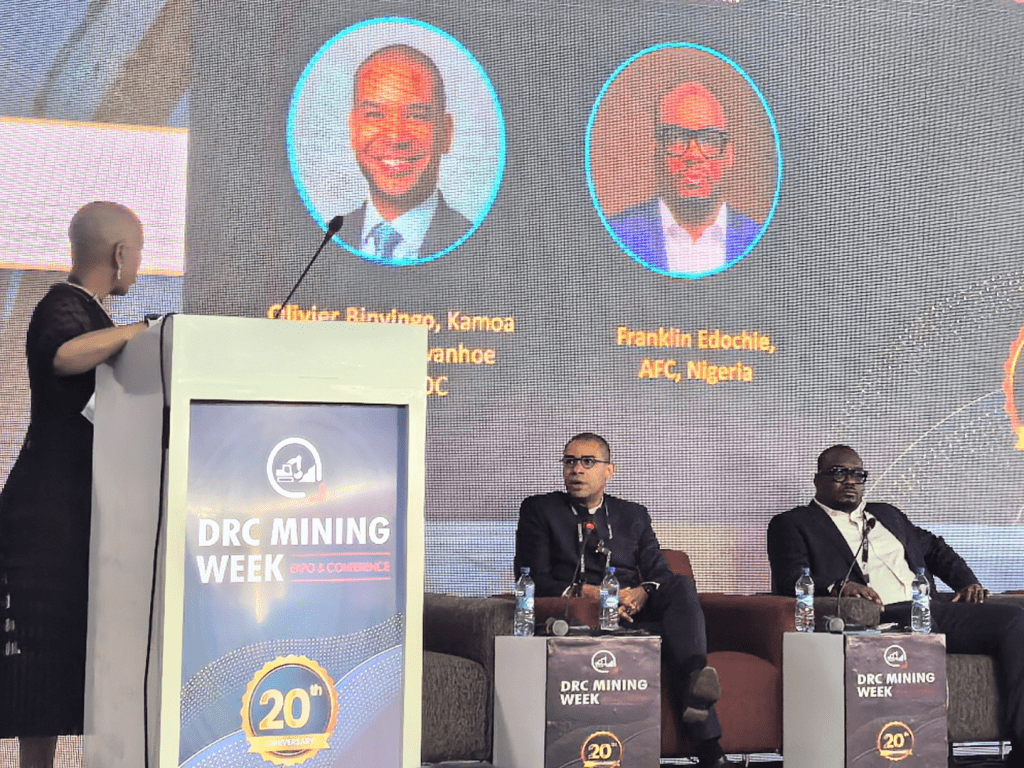

In a session moderated by Bongiwe Mabusela, Director of Empowerment Transactions Assessment at South Africa’s Department of Mineral Resources and Energy, participants Franklin Edochie, Head of Metals & Mining, Africa Finance Corporation (AFC) in Nigeria, and Olivier Binyingo, Chairman of the board at Kamoa Copper SA/EVP at Ivanhoe Mines, outlined the unique investment proposition of the DRC and the steps being taken to transition from potential to dominance.

Binyingo captured the essence of why the DRC has become a hotspot for mining investments. “The DRC has long been known for its mineral wealth. But today, it’s no longer just potential—it’s a realised reality.”

ALSO READ:

DRC Mining Week 2025: Celebrating legacy, shaping tomorrow

“Ivanhoe Mines, through its founder Robert Friedland’s vision, was one of the early believers in the extended potential of the Copperbelt. “The extensive exploration west of Kolwezi in Lualaba resulted in one of the most significant copper discoveries in recent history,” stated Binyingo.

Binyingo highlighted that beyond copper, DRC is now home to:

- The largest cobalt production globally

- The biggest zinc project in Africa

- The largest coal and copper projects on the continent

Binyingo emphasised that these achievements are more than geological luck—they prove that “you can invest, develop, and operate successfully in the DRC.”

Energy transition

Binyingo highlighted how DRC’s vast copper reserves position it at the centre of the global green energy transition. With rising global demand for copper—driven by electric vehicles, data centres, and energy grid modernisation—the DRC stands to benefit enormously in the coming decades.

“We are already the second-largest copper producer in the world. Only Chile produces more. This is not just potential—it’s dominance in the making,” he added.

Why invest in the DRC?

Edochie provided a financier’s perspective. He identified three core factors that make the DRC an attractive investment destination:

- High profit margins: Despite infrastructure constraints, DRC projects—such as the Kamoa project—boast some of the highest margins globally, ranging between 50 and 50–60%.

- Regulatory certainty: Contrary to outdated perceptions, the DRC now offers policy stability and clarity around legal frameworks, taxation, and repatriation of profits.

“Investors like predictability. The DRC is delivering on that,” Edochie noted. - ESG Alignment: AFC and other institutions require environmental and social compliance. Franklin praised the DRC’s growing alignment with global ESG standards, emphasising the importance of uplifting local communities around mining projects.

Infrastructure challenges

Binyingo and Edochie both stressed infrastructure as a key area for growth. “No country can develop in the dark,” Binyingo remarked. Energy, roads, and logistics remain challenges, but the mining boom provides the leverage to address them.

Edochie shared how AFC is taking an ecosystem approach—investing in the Lobito Corridor, the Kinshasa Rail Project, and multiple hydropower and renewable energy ventures to power not only mines but also communities and industrial hubs.

Another key point highlighted was localisation and capacity building. “Mining shouldn’t be the only thing we pioneer—the ecosystem around mining is where transformation lies. “Service providers, subcontractors, and local businesses must be equipped to participate and scale,” said Binyingo.

He also shared that he envisions a future where Congolese drilling companies, caterers, and equipment suppliers become regional exporters of expertise, especially as neighbouring countries like Zambia ramp up their mining ambitions.

As the session concluded, Mabusela emphasised that any investor must also be prepared to uplift local communities and include Congolese citizens in the journey forward. “We cannot move forward without the people of DRC.”

Binyingo pointed to cross-border partnerships and public-private collaboration as levers to unlock regional development. Edochie echoed the call for value addition and local beneficiation as the next step in Africa’s mining evolution.

In another panel discussion titled ‘Mining Roadmap: Drawing the Future Trajectory of DRC’s Mining Sector’ Abdul-Rasheed Saro, Corporate Executive & Mining Sector at FirstBank in DRC, highlighted the challenges and opportunities for banks in supporting the mining industry, especially small-scale and artisanal miners.

He highlighted these key points:

- Low financial literacy among miners makes it difficult for banks to understand and support their needs. Improving financial education and inclusion is crucial.

- Banks are developing asset-based structured finance products (e.g., loans for excavators and tippers) to reduce risk and increase lending opportunities.

- There is a need for shared risk mechanisms, including a more robust and tailored insurance market for lower-tier miners.

- Technical competencies and ESG compliance are vital. Miners must operate responsibly to avoid risks that could affect the entire ecosystem and discourage bank involvement.

- Most small-scale miners lack collateral and operate informally, making it difficult for banks to track transactions and assess creditworthiness.

He concluded by calling for greater collaboration among government, banks, and large mining companies to improve policy environments, education, and support systems, enabling more effective financial integration of small-scale miners.