After years of stagnation, early-stage exploration is getting its groove back. Capital is quietly rotating back into juniors with tight structures, real technical ground, and near-term discovery potential.

Ridgeline Minerals Corp. (RDG:TSX.V; RDGMF:OTCQB; 0GC0:FRS) is one of the juniors positioned to benefit from this shift. The company is a discovery-focused precious and base metal explorer with a seasoned technical team and a 200 km² exploration portfolio spanning seven projects in Nevada, U.S.A.

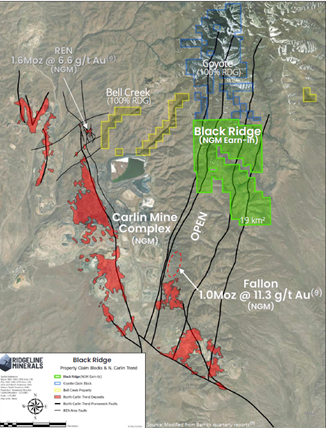

Ridgeline combines 100%-owned assets (Big Blue, Atlas, Bell Creek, and Coyote) with three strategic earn-in agreements totaling up to US$60M in expenditures, two with Nevada Gold Mines (Swift and Black Ridge) and one with South32 (Selena). This is not a company chasing its next financing; it’s positioned to chase its next discovery.

A Proven Nevada-Focused Team

Ridgeline’s leadership is one of its core advantages. CEO and founder Chad Peters is a veteran exploration geologist with deep Nevada roots, having held senior technical roles at Premier Gold Mines (now I-80 Gold), where their team discovered over 10 Moz of gold.

Since founding Ridgeline in 2018, he has instilled a culture of disciplined, systematic exploration, prioritizing geology over hype and long-term value over short-term optics. His team includes professionals with track records of discovery and project advancement in Nevada, and their work has already drawn the attention of top-tier partners. Backed by smart money and driven by technical conviction, this is a team built to make discoveries and advance them responsibly.

The Chart: Coiled Between Support and Resistance

Ridgeline’s chart continues to show a constructive technical setup that appears to be coiling for a move. After a powerful advance earlier this year, the stock has pulled back to a key technical juncture: the confluence of the rising long-term support line, the 200-day moving average, and the 0.618 Fibonacci retracement level.

This zone, roughly between CA$0.16 and CA$0.17, has already shown signs of providing support. The volume has tapered into this level, and the stock is now pressing against a declining downtrend line that has defined the corrective phase since the February highs.

A decisive breakout above this downtrend line, especially on volume, would likely trigger the next leg higher.

Technical targets remain intact:

- CA$0.30, the former pivot and psychological level

- CA$0.43, the upper boundary of the 2023 consolidation zone

- Big Picture Target: CA$0.50, if a full re-rating unfolds

Momentum indicators are starting to turn. MACD is curling higher from deeply oversold levels, and RSI has reset into neutral territory. This is often the zone where trend reversals form — especially when aligned with strong fundamental drivers.

This chart is no longer about “hope.” It’s about structure.

Ridgeline is basing on meaningful support, and a technical breakout above the trendline would likely draw renewed interest from both technical traders and sector-focused speculators.

The Investment Case for Ridgeline Minerals

- Five Active Projects (seven in total) with a US$11M 2025 Exploration Budget

Ridgeline has five projects being drilled this year, with US$9.5M of the US$11M exploration budget being funded by partners. The company retains 75–80% non-dilutive ownership in its JV projects, giving shareholders massive upside potential without capital risk.

- Big Blue Delivers Bonanza Silver-Copper-Tungsten Hit

At its 100%-owned Big Blue project, Ridgeline reported a standout intercept of 0.6m grading 3,194 g/t Ag, 0.7% Cu, and 2.6% W. This came from a high-grade feeder zone 500m beneath the historic Delker Mine. While the market reaction was muted, the result validates the system and has opened the door to a potential JV partnership. - Selena CRD Program Underway with South32

Selena is now being drilled under a US$3.5M budget from South32, targeting a high-grade CRD system analogous to Arizona Mining‘s Taylor deposit (bought for US$1.8B in 2018). Assays are expected from:

- Hole #1 in September, Hole #2 in October, Hole #3 in November

- Any one of these could prove transformational.

- Swift and Black Ridge Backed by Nevada Gold Mines

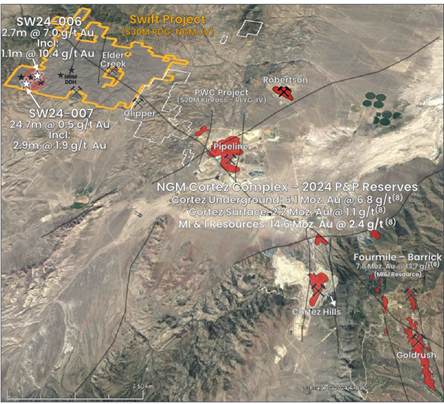

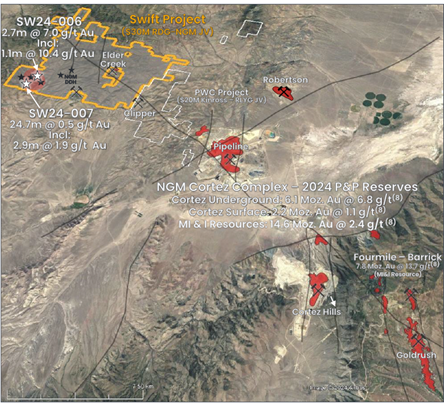

Nevada Gold Mines (Barrick + Newmont) is spending US$5M at Swift and US$1M at Black Ridge in 2025. Swift is targeting extensions of last year’s 10.4 g/t Au hit over 1.1m, a potential grass-roots gold discovery in the making that’s directly on trend of the 50+ Moz. Cortez district. Both programs begin drilling in July, with assays expected from October through Q1 2026.

- Atlas Assays Coming Late July

The maiden drill program at Atlas tested Carlin-style oxide gold in the same rocks that host Orla Mining’s Dark Star deposit. Given the initial 2-hole program’s scope, expectations are modest, but the 100% ownership and early-stage nature give Atlas longer-term optionality. - Spartan Metals Spinout Unlocks Value at Zero Cost

Ridgeline sold its Eagle Tungsten project to Midasco Capital (soon to be Spartan Metals), keeping:

- A 20% equity stake (non-dilutive for one year)

- A 1% NSR on all metals

- Eagle includes two of the highest-grade past-producing tungsten mines in the U.S., with copper and rubidium credits. This is quiet embedded value that could re-rate independently of Ridgeline’s gold and silver exploration.

- A Tight Structure with Long-Term Backers

Ridgeline has ~140 million shares outstanding, 8% insider ownership, and no messy legacy structures. Strategic backers include EMX Royalty, Merk Investments and Rick Rule. This is a team that’s building for the long haul, and they’re aligned with shareholders.

Final Word: A Speculative Buy Before the Crowd Wakes Up

With active drill programs across five Nevada projects, major JV partners funding most of the expenses, a chart that found support, and appears to have limited downside at these levels. Ridgeline has everything we look for in a high-leverage junior explorer.

From now through early 2026, the company will be delivering consistent news flow, results that could mark the transition from speculation to discovery.

At current levels near CA$0.17, I view Ridgeline Minerals as a Speculative Buy for investors seeking exposure to Tier-1 jurisdiction discovery with minimal dilution risk.

More details are available at the company’s website here.

Ridgeline Minerals Corp. (RDG:TSX.V; RDGMF:OTCQB; 0GC0:FRS) closed for trading at CA$0.18, US$0.125 on July 22, 2025.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it’s advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.