Aura Energy is targeting 2027 for first production from its Tiris uranium project in Mauritania. Aura’s CEO, ANDREW GROVE, tells ARTHUR TASSELL that the company is making excellent progress on multiple fronts as it works towards making a Final Investment Decision (FID) by the end of this year. Tiris will be Mauritania’s first uranium mine and will produce an average of 1.8 million lb (Mlb) a year of uranium oxide (‘yellowcake’) over a mine life of 25 years.

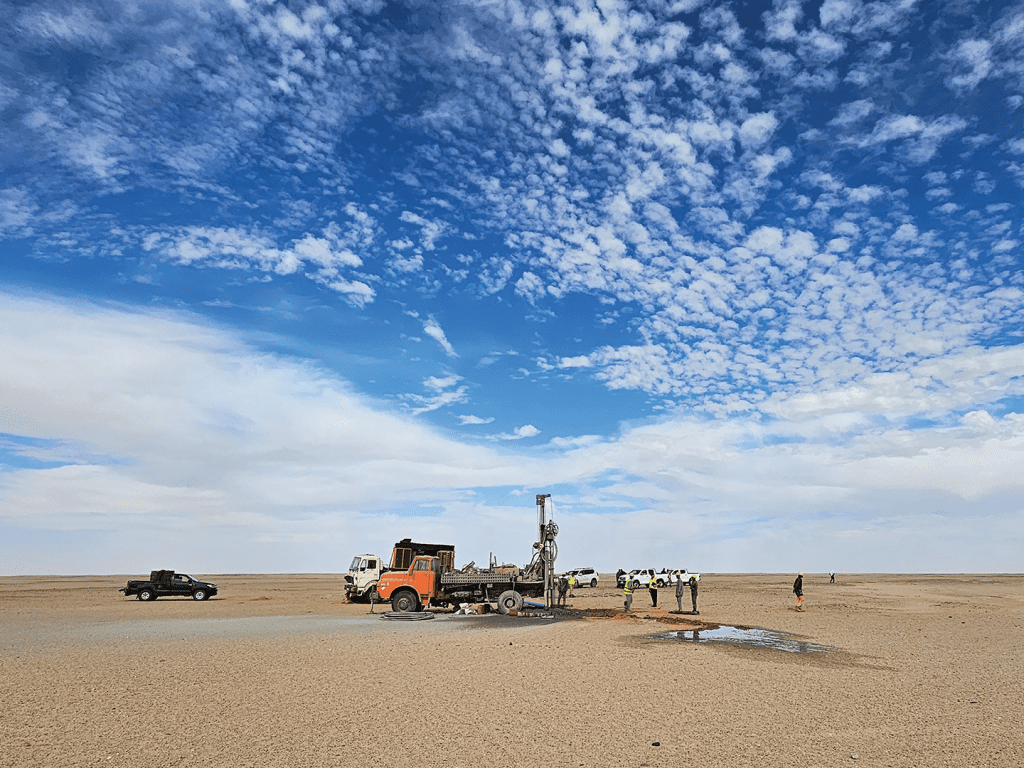

Located in the Sahara Desert in northeast Mauritania, Tiris is a greenfield calcrete uranium project and represents the first major calcrete uranium discovery in the region. The site is extremely remote, being located approximately 1 400 km from Mauritania’s capital, Nouakchott. The nearest settlement, the town of Zouérat, lies 680 km to the south-west.

Access to the site from Zouérat is by a hard-pan desert track, a journey which typically takes 10 to 11 hours. “Tiris – which is fully permitted – has been extensively explored and studied since first being discovered by Aura in 2008 and it is clear that it represents an outstanding uranium opportunity,” says Grove. “At current uranium prices, the economics are extremely attractive. Moreover, the capex – estimated at US$230 million – is relatively low compared to most other uranium projects in Africa. “The procurement process for major items of plant and equipment is well advanced and we’re currently also working on an early works package – which will include a frontier camp, an airstrip and some access roads – for implementation later this year.”

Grove, an Australian geologist, was appointed as Aura’s CEO in early 2024. He has extensive West African development, operational and financing experience, and was most recently MD and CEO of Chesser Resources, whose main asset during his tenure was the Diamba Sud gold project in Senegal. Chesser was acquired by Fortuna Silver Mines for a 95% premium in late 2023. In February last year, Aura, listed on the ASX and AIM, released the results of a FEED study on Tiris which updated the technical and financial parameters of the 2023 Enhanced Feasibility Study (EFS).

The figures presented in the FEED study have since been further enhanced to reflect a considerable increase in the project’s mineral resource, which now stands at 91.3 Mlb U3 O8 at a grade of 225 ppm. Tiris is now expected to have a 25-year mine life (compared to the 17 years contemplated in the EFS and the FEED study) and over this period will produce an average 1.8 Mlb per annum U3 O8 from a 2 Mlb U3 O8 per annum capacity process plant at an AISC of US$35.7/lb U3 O8 . Production over the first 10 years will run at a higher level of 2.1 Mlb per annum U3 O8 . The project delivers a post-tax NPV8 of US$499 million with an IRR of 39% based on a uranium price of US$80/lb. Payback of the capex is achieved in only 2.25 years.

Mining operation

The uranium resources at Tiris generally lie either within weathered, partially decomposed red granite or in colluvial gravels developed on or near red granites. The uranium mineralisation occurs principally as carnotite and mostly occurs within 5 m of surface. “One of the great strengths of the project is the shallow, free-dig nature of the mineralisation,” says Grove. “The average depth of the pits we intend developing is 4.7 m and there is no need for any drilling or blasting. There is also very little prestripping required – in fact, the strip ratio, waste to ore, is just 0.8 to 1. As a result, our mining costs will be exceptionally low.” The ore reserves at Tiris are distributed over six distinct areas known as Lazare North and Lazare South, Sadi North and Sadi South, and Hippolyte North and Hippolyte South. Aura will be adopting a ‘hub-and-spoke’ mining and processing model which will see multiple pits being developed in each of these areas over the life of mine (LoM).

ALSO READ:

Coal and Energy Transition Day: Shaping Southern Africa’s energy future

The ore will be concentrated in beneficiation plants serving each mining area with the beneficiated ore then being sent as a slurry via HDPE pipelines to a central leach/precipitation plant which will be located at Lazare North. The remaining mining areas are all located within a 35 km radius of Lazare North. Explaining the rationale for having beneficiation plants at each mining area, Grove notes that the Tiris ore is easily concentrated by means of simple rotary wet scrubbing and screening. “Our test work has confirmed that a -75 micron screen size results in the recovery of 91% of the U3 O8 into 13% of the original mass,” he explains. “It therefore makes sense to beneficiate in the mining areas and create a highgrade slurried product that can be pumped to a central processing facility. Using this approach, we generate a high-grade leach feed which will average 1 752 ppm U3 O8 over the LoM. This translates into a much smaller leach plant than would otherwise have been required.”

In all, four modular beneficiation plants will be required over the LoM, each with a throughput capacity of 1.25 Mtpa. The plants will be designed to be transportable, as they will need to be relocated on occasion as the project advances. Each relocation will take about four weeks. “We will start mining at Lazare North and Sadi South and each of these areas will be served by two beneficiation plants,” Grove explains. “In Year 4, we’ll move one of the Lazare North beneficiation plants to Lazare South and in Year 7 one of the Sadi South units to Sadi North. As the project progresses and Lazare North and Sadi South are mined out, there will be further plant relocations to the Hippolyte resource areas in the west of our tenement area.”

ALSO READ:

Coal and Energy Day: The future of coal in Southern Africa

Commenting on the proposed mining operation, Grove says it will very likely be undertaken in-house. “Contract mining wouldn’t make sense for something this simple,” he observes. “At each mining area, we’re looking at probably a single 60-tonne class excavator, a couple of 56-tonne payload trucks and a wheel loader. Because of the nature of the orebodies, we anticipate developing multiple shallow pits in each area which allows considerable flexibility in accessing the ore. Total material movements yearly will be just under 7 Mt.” He adds that mining will follow a strip-mining philosophy, where any waste mined will be returned to a previously mined area without the need for building waste dumps or rehandling. “This ‘real-time rehabilitation’ results in significant savings in waste movement and rehabilitation costs,” he states. Discussing the central leach plant, Grove says this is of conventional design with the flowsheet based on leaching, filtration and ion exchange, followed by uranium purification and precipitation, calcining and packing.

The final uranium oxide concentrate will be packed in steel drums and strapped within 6 m containers for transport by road to the Port of Nouakchott. “The throughput capacity of the plant will be 0.52 Mtpa and no crushing or grinding is required,” he says. “We will be using a heated alkaline leach, which is the same method used at Paladin Energy’s Langer Heinrich mine in Namibia. One advantage we have over similar calcrete deposits is that our ore is very fine-grained which results in very rapid leaching, with the reaction essentially complete within eight hours.

This compares very favourably with other calcrete projects where leach times of 96 hours can be required.” Grove points out that the processing plant will have a modular design which is well suited to capital efficient and simple expansion to accommodate accelerated processing of Tiris’s existing mineral resource base. “We’ve assessed options that could see mining rates being accelerated early in the project life,” he says. “The scenarios we’ve looked at are a mining rate of 6.25 Mtpa, producing approximately 3 Mlb per annum U3 O8 , and a mining rate of 8.2 Mtpa producing approximately 4 Mlb per annum U3 O8 . Both options improve the metrics of the project quite significantly.” With Tiris being located in a hyperarid desert environment with little rainfall, the project – which will require 160 m3/h of water once in production – will have to rely on boreholes for its water needs.

Extensive hydrogeological studies by Tiris (assisted by Knight Piésold Consulting) have confirmed the availability of sufficient water resources to support future operations. Part of this will come from the C22 borehole area, around 22 km north-west of the processing plant, but the primary source will be the Touadeni Basin area, around 100 km to 120 km south of the plant. This basin also supplies water to Mauritania’s iron ore mines. In terms of electrical power, Tiris –which will need up to 12 MW will have to be self-sufficient. It is anticipated that diesel generators will be used to meet the needs of the beneficiation plants with a hybrid solar/diesel solution powering the main plant. ECG Engineering, a specialist power-generation consultancy based in Australia, has been appointed to define a power generation solution.

Project implementation

To assist in preparing for implementation of the project, Aura has appointed Wood as its engineering partner for basic engineering and early works package definition. This arrangement is expected to evolve into a full EPCM contract. Wood, a leader in consulting and engineering with a global workforce numbering around 35 000 people, has extensive uranium experience.

It is currently executing the detailed engineering on Bannerman’s Etango uranium project in Namibia and was the lead EPCM contractor on the huge Husab uranium mine, also in Namibia. Its expertise also extends into alkaline leaching of uranium, notably for the Langer Heinrich project. In anticipation of project implementation, Aura recently appointed Mohamed Sid’Ahmed as General Manager Operations (GMO). A Mauritanian national and experienced mining executive and mining engineer, he was most recently GMO of the Goulamina lithium mine in Mali, which recently entered operations. He has also held executive roles with Kinross at the Tasiast gold mine in Mauritania and at the Sabodala gold mine in Senegal when it was still owned by Teranga Gold Corp.

In all, Aura currently has 27 employees. Grove and several senior executives are based in Perth, Western Australia, but the company also maintains an office in Nouakchott, where country manager Mohamed El Moctar Mohamed El Hacene is based. He is a highly experienced Mauritanian professional with a wealth of experience in mining and international affairs and served as Mauritania’s Minister of Mines in 2007 and 2008.

Once Tiris is in production it will represent a welcome addition to Mauritania’s mining industry, which accounts for nearly a quarter of the country’s GDP. The country is a major producer of iron ore through SNIM, the state-owned mining entity, and also hosts Kinross’s Tasiast gold mine, one of Africa’s largest gold producers, as well as First Quantum’s smaller Guelb Moghrein copper/gold mine. The country, in conjunction with BP and along with neighbouring Senegal, is also starting to develop offshore gas resources.

“The Mauritanian government is keen to grow the mining industry and is providing strong support to Aura. Tiris is probably the most advanced mining project in the country and will put Mauritania on the map as a significant uranium producer. Moreover, the mine could be just the start of bigger things. We’ve submitted around 13 000 km2 of new tenement applications –which is 28 times our current tenure – and believe that Tiris could become the anchor point of a new emerging uranium province in northern Mauritania,” Grove concludes.