AIM-listed Andrada Mining, whose current revenues derive mainly from the production of tin concentrate from its Uis mine in Namibia, is pushing forward vigorously with its strategy of evolving into a diversified producer of several of the critical metals needed for the global green energy transition. The company’s CEO, ANTHONY VILJOEN, recently updated ARTHUR TASSELL on the progress being made not only at the Uis operation but also at the company’s Lithium Ridge and Brandberg West development projects.

The company is already producing tantalum as a by-product at its Uis operation and is also well on its way to commercialising the plentiful lithium resources it has at its Uis property and also at its Lithium Ridge project, 35 km south-east of Uis. On the development horizon, the Brandberg West project, located 110 km to the west of Uis, has the potential to add tungsten and copper to the company’s product mix. “We’re very excited at the way Andrada is evolving,” says Viljoen. “When we entered Namibia in 2016, we were totally focused on tin production and this strategy has paid off as the demand for tin has generally been strong since we started operations. In fact, the price of the metal has virtually doubled since December 2019.

Nevertheless, our belief is that it is unwise to be dependent on a single mineral and our current initiatives are designed to transform Andrada into a multi-asset, multi-metals producer with multiple revenue streams.” He adds that the beauty of the Andrada orebodies is that the lithium and tantalum are contained in the same ore that hosts the tin. “We are already mining the ore for the tin so extracting the lithium and tantalum is simply a processing issue – there are no significant additional mining costs. In a sense, we are almost getting tantalum and, prospectively, the lithium for free,” he says. Viljoen has a long history of entrepreneurship in mining over multiple commodities and jurisdictions and his past ventures have included Lemur Resources and Bushveld Minerals. Andrada (once known as AfriTin) is, in fact, a spin-off from Bushveld and was established in 2016 to operate the Uis mine. At that stage, Uis – which was mined continuously from the late 1950s through to 1990 by an Iscor subsidiary and ranked at one stage as the world’s largest hard-rock open-pit tin mine – was an abandoned property which had been stripped of its assets and had no workable infrastructure.

ALSO READ: Proposed restructuring of Andrada’s main operating company

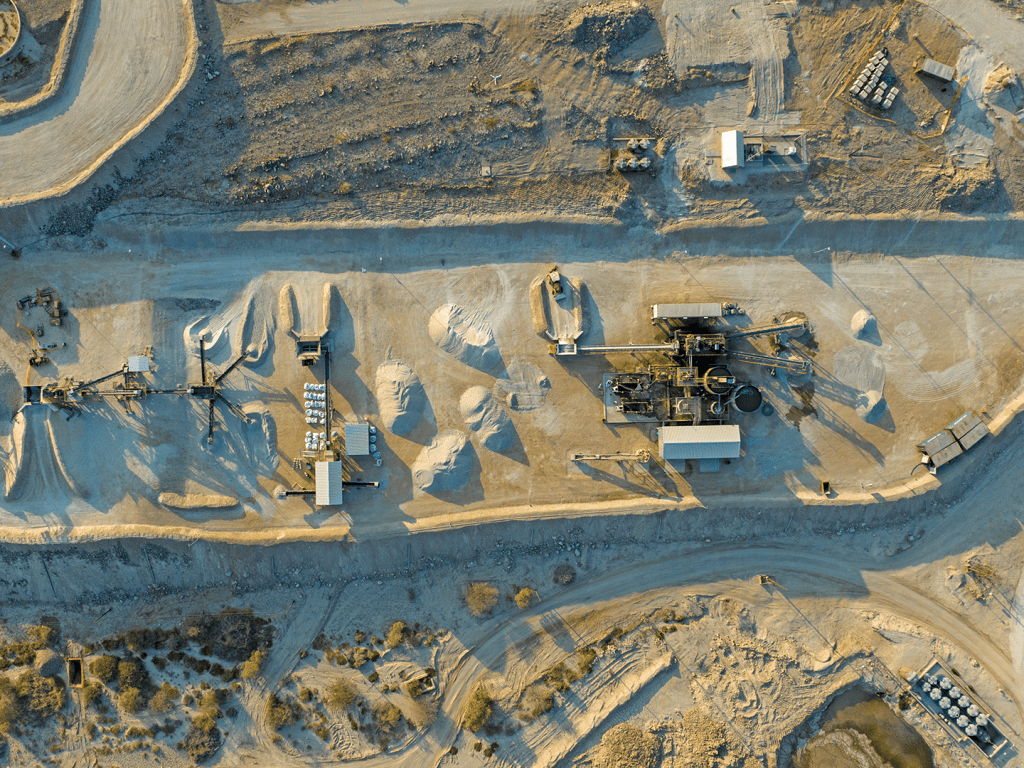

“Most of the equipment had either been removed or was in a state of total disrepair, so we had to start from scratch,” Viljoen recalls. “We managed to get up and running with a pilot plant in 2019 and we’ve never really looked back. The plant – based on the use of DMS units – has been progressively expanded and upgraded since startup and the current throughput rate is roughly 1 Mtpa. Plant utilisation is consistently over 90% and the tin recovery is running at up to 75% in the past 12 months. “In our 2024 financial year – through to the end of February 2024 – we produced 1 474 tonnes of tin concentrate, representing nearly 900 tonnes of tin metal, which was a 54% year-on-year improvement on the previous year, and this upward trend is continuing. We can potentially expand our tin production by about 100% using just our existing infrastructure.”

Plant upgrades

He notes that the original plant was certainly not a ‘Rolls Royce’ facility. “As a cash-constrained junior miner, our strategy was to get into production with a low-cost plant – much of it based on used equipment – which we could later expand and modify as our understanding of our orebody grew over time.” Among recent initiatives to upgrade the plant, Andrada has commenced a preconcentrating project to increase tin grade and output. This involves improvements to the dry processing section through the installation of a coarse crushing and XRT ore-sorting pre-concentration circuit.

A continuous improvement (CI2) programme to improve the efficiency of the plant and drive down costs is ongoing and is reportedly delivering good results. Containing costs is critical to Andrada given that its AISC in FY-2024 was a relatively high US$26 223 per tonne of contained tin. While Viljoen is not himself a geologist he has geology in his blood. His father is Richard Viljoen, a geologist with an international reputation, while his uncle, the late Morris Viljoen (Richard’s twin), also carved out a highly distinguished career in the geological field. Morris and Richard were both involved in the initial evaluation of the Uis property. “When we took over Uis, all we had in the way of a resource was some historical Iscor data and it was not until 2019 that we produced a Maiden Resource Estimate for the V1/V2 pegmatites that we are currently mining,” he says. “This not only confirmed that we were sitting on a very substantial tin resource, but it also gave us our first insight into the tremendous lithium and tantalum potential of the orebody, two metals that Iscor had never been interested in – and had never quantified – as there was no demand for them in the period it operated the mine.”

Andrada has just updated the V1/V2 resource. The total tonnage of mineralised pegmatite is now estimated at 77.5 Mt containing 118 kt of tin, 610 kt of lithium oxide (Li2 O) and 6.4 kt of tantalum. Interestingly, the orebody is also estimated to contain 105 kt of rubidium (Rb), representing a globally significant resource of this little-known metal. While the Uis orebody has a relatively low tin grade of just 0.15%, the ore is easily mined by open-pit methods. Moreover, as Viljoen points out, the huge advantage that Uis has – compared to many other deposits worldwide – is that it is located in a stable democratic country with excellent infrastructure and a wealth of mining skills. Logistics are also simple, as the property is located in Namibia’s Erongo region, just 230 km from the international port of Walvis Bay. Although the current resource at Uis is more than sufficient for the mine to operate for many years, there is huge exploration upside in the nearly 20 000 ha Uis licence area.

ALSO READ: Andrada Mining chooses TOMRA technology for Uis Mine

“We have identified around 180 pegmatites over just 5% of the licence,” says Viljoen. “We already have a 135 Mt resource in respect of V1/V2 and some neighbouring pegmatites known as the proximal pegmatites and our target resource for this cluster is 200 Mt. We also see potentially a further 200 Mt in the broader licence area.” Andrada has just secured US$2.5 million of funding to allow it to construct an additional tin processing plant with a processing capacity of 100 tph. Comprising a three-stage primary crushing circuit, a jigging section and shaking tables, the plant will allow modular expansion of operations into the proximal pegmatites without disrupting current production.

Impact on the local economy

Viljoen points out that the Uis operation has created hundreds of jobs in an area which was plagued by unemployment in the wake of the closure of the Iscor mine. The mine now employs approximately 240 people directly and a further 230 indirectly through its contractors (notably Nexus, a local company which is responsible for the open-pit mining). Around 99% of the employees are Namibian. “We’re particularly proud of the fact that just over 21% of our employees are women, who also fill 25% of our senior management roles,” says Viljoen. Turning to Uis’s tantalum and lithium potential, Viljoen says major steps forward were taken in FY-2024 with the completion of a tantalum production circuit within the main plant and the construction and commissioning of a lithium pilot or bulk sampling plant adjacent to the main plant. The tantalum circuit, based on a magnetic process to separate out the tantalum from the tin concentrate, produced its first saleable tantalum concentrate early in calendar 2024. Production is currently running at nominal rates (25 tonnes of tantalum concentrate were produced in the six months to 31 August 2024) but Viljoen says this is expected to ramp up in the coming months.

“It’s early days yet,” he says. “Once you understand how the material behaves in the plant, it’s all about optimisation and we’re working hard on this.” As regards the lithium pilot plant, this was commissioned in October 2023, producing approximately 10 tonnes of petalite concentrate during the process. Consisting of crushing and screening equipment, a DMS module and a gravity circuit, it is currently being used primarily for offtake bulk sampling campaigns. Aside from the lithium pilot plant, the big news from Andrada on the lithium front is its partnership, announced in September last year, with SQM Australia (Pty) Ltd, a subsidiary of SQM Chile, in respect of its 3 300 ha Lithium Ridge licence.

Fully permitted for mining, Lithium Ridge – which once hosted the small TinTan mine – has multiple pegmatites containing lithium (mainly contained within spodumene mineralisation which is in contrast to the Uis resource which is petalite dominant), tin and tantalum. Exploration programmes to date have found continuous mineralisation along 6 km of strike with RC drilling having intersected grades of up to 2.13% Li2 O. Although exploration is still in the early stages, Andrada has already produced a high-grade spodumene concentrate (6.8% Li2 O) by laboratoryscale flotation from drill samples.

In terms of the three-stage, earnin agreement, which has now been unconditionally approved by the Namibian Competition Commission (NaCC), SQM has committed to spending up to US$40 million to earn up to 50% of the project. “SQM is a phenomenal partner for Andrada,” comments Viljoen. “It’s a company we’ve known well for several years, and we’ve had the opportunity to visit its lithium brine projects in South America, which are extremely impressive. Although Lithium Ridge is its first lithium foray into Africa, SQM is one of the world’s largest lithium chemicals producers with formidable technical and financial resources, and we believe its involvement in the development of Lithium Ridge will expedite the development of this worldclass resource.”

Andrada and SQM will form a Joint Development Committee (JDC) to oversee the development work and, as this article was being written, work was about to start on establishing the Stage 1 implementation plan. This initial stage includes extensive exploration of the licence area and will involve expenditure of US$7 million. While Lithium Ridge’s resource is (like Uis) a pegmatite, Brandberg West, Andrada’s other major development project, is a quartz vein system. The exploration licence covers an area of approximately 35 000 ha and hosts an historic open pit mine previously owned and operated by Gold Fields between 1957 and 1980. It is estimated to have produced over 12 kt of tin and tungsten concentrate during its life. Andrada completed an inaugural drill programme at Brandberg West last year.

This was aimed at providing an initial indication of the grade potential and geology of the historical open pit area and to investigate the potential mineralisation of the northern extensions. The latest batch of drill results reported grades as high as 10.55% for tin, 3.53% for tungsten and 1.95% for copper. According to Viljoen, the copper mineralisation at Brandberg West, which was missed – or ignored – by Gold Fields is very evident from the waste dumps and some areas of the pit, where sulphide material containing copper has oxidised and turned green over time. “We took a Niton XRF analyser to site and shot some samples, which had copper grades of up to 3%,” he says. “Brandberg West is shaping up as an excellent project. It’s still at an early stage and we don’t even have a resource yet, but we’re convinced that it can be developed into a mine, perhaps starting with an operation to retreat the rock dumps. Given its distance from Uis, it would most likely have to be a standalone operation. We’re prepared to go it alone with Brandberg West, but we certainly don’t rule out the type of partnership that we now have in place for Lithium Ridge,” says Viljoen.

Summing up the state of play with Andrada, Viljoen says the company is currently in good shape and making real progress to fulfil its vision of being a multi-metals producer. “We already have two revenue streams from tin and tantalum, and we believe it won’t be long before we start to produce lithium in commercial quantities at Uis,” he states. “Further out, Lithium Ridge and Brandberg West offer additional opportunities for the company. If we get these projects into production, then Andrada will emerge as probably the pre-eminent multi-metals producer in the southern African region. This is an ambitious goal, but I believe what we’ve already achieved since entering Namibia nearly a decade ago shows that it is also a realistic one.”