When the news of London-headquartered Jubilee Metals selling its chrome and platinum group metals (PGM) operations to private mining and metals trading company One Chrome surfaced, I started wondering what was happening.

Join our WhatsApp channel for more updates on mining in Africa

But then I quickly realised that this probably aligns with global trends that seem to favour copper, amid a worldwide surge in electrification, and strong copper markets also supporting higher margins than chrome, with countries such as Zambia presenting material opportunities to expand copper-producing assets.

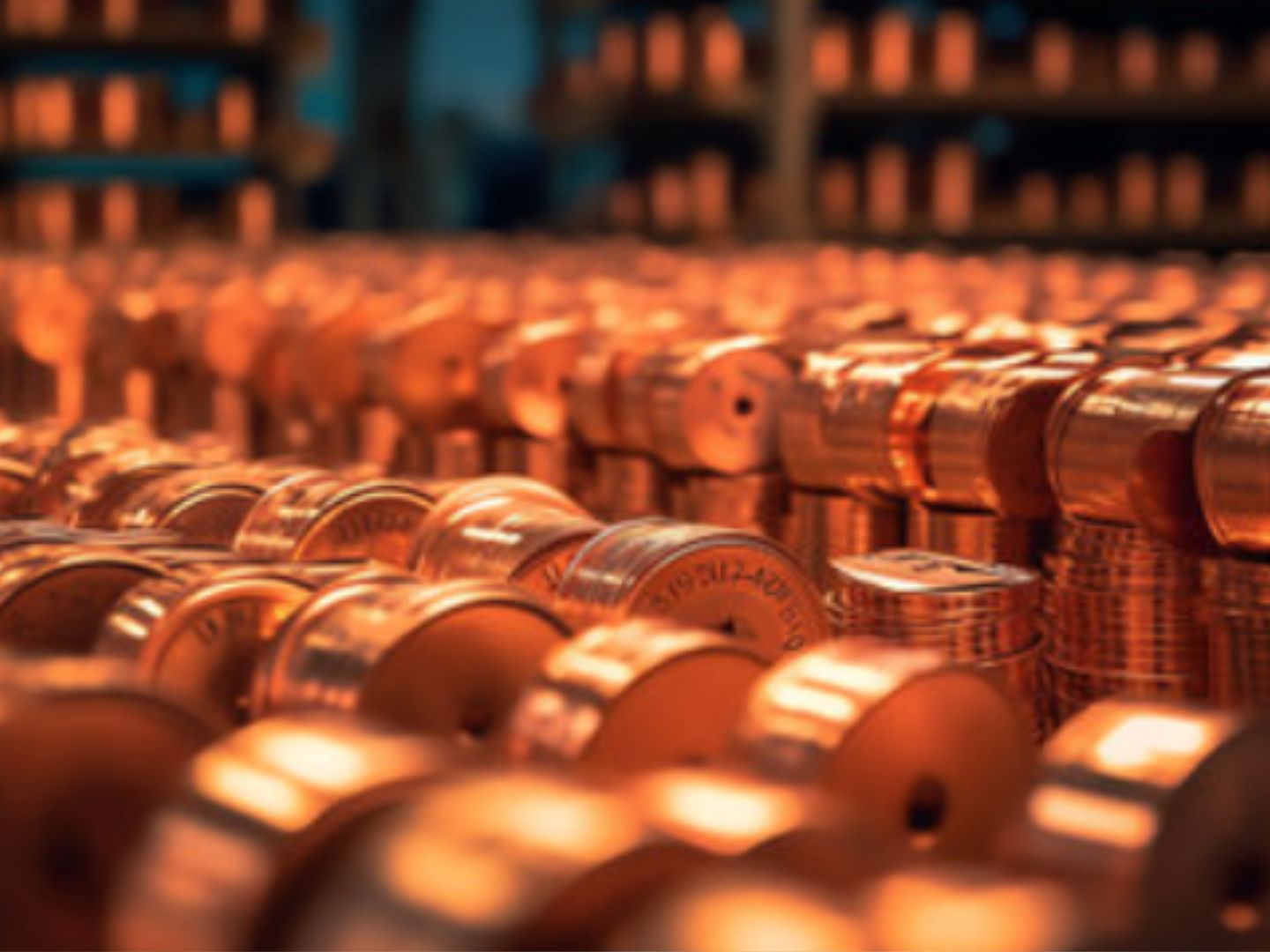

Copper has become the new strategic raw material at the heart of the global energy transition and digital transformation.

It is essential for electric vehicles, renewable energy systems, data centres, AI infrastructure and smart grids, among other things.

While Jubilee will retain rights to the Tjate platinum project in Limpopo, it will be eyeing Zambia’s expanding role in global copper production.

The company’s sale of its chrome and PGM operations reflects a strategic pivot to focus on its copper operations in Zambia, where it seems to see greater long-term value. It plans to allocate resources to its copper operations there, citing higher growth and improved margins.

ALSO READ: Jubilee Metals receives $90M offer for SA chrome and PGM assets

Maybe we need to accept that chrome and PGM operations in South Africa have reached a significant level of maturity, with growth opportunities starting to be limited. By contrast, copper seems to offer higher earnings potential and stronger market fundamentals.

According to UN Trade and Development’s Global Trade Update, global copper demand is expected to grow by over 40% by 2040. However, supply is currently not keeping up with this demand.

The likelihood is that meeting this demand may require in the region of 80 new mines and about $250 billion in investment by 2030.

Jubilee’s sale signals a broader realignment of Africa-focused mining strategies. Zambia’s copper potential, buoyed by global demand for electric vehicles and renewable energy infrastructure, is emerging as an attraction for new investment.

Africa’s mining landscape is evolving. The jury is still out on whether mining has become one of South Africa’s economic sectors that have reached high maturity levels. But perhaps Zambia’s growing copper potential is a vote of confidence in the continent’s broader resource-driven future.

A surge in global demand for critical energy transition minerals (CETMs) can benefit Africa. These minerals, such as copper, cobalt, graphite, lithium and rare earths are essential for manufacturing renewable energy technologies like solar panels, batteries and wind turbines.

ALSO READ: Ivanhoe Mines enters new growth phase with strong output across key projects

As producers of key CETMs, countries such as Namibia, Zambia and Madagascar are well-positioned to benefit. However the challenge still lies in moving beyond extraction to value addition and broader economic diversification.

As critical minerals become central to both the energy and digital transitions, it is essential that developing countries be empowered to move beyond extraction and shape their own development paths.

Greenfield projects in Africa have seen a 90% increase in copper production over the last decade. And the growth in the supply of copper over the next 10 years is likely to be dominated by regions such as Africa, Latin America and Asia Pacific, with Africa likely to have the highest growth rate.

It’s clear that copper presents an opportunity for African mining to keep shining.