Few investors realize the U.S. has no active tungsten mines today. That may change sooner than most expect. American Tungsten Corp. (TUNG:CSE; TUNGF:OTCQB; RK9:FSE) is advancing the past-producing IMA Mine in Idaho on patented claims, aiming for an imminent restart for small-scale tungsten production that would account for 8% of U.S. demand while drilling to grow the resource and derisk the molybdenum porphyry below the historic workings.

About the Company

American Tungsten is a Canadian company focused on bringing a domestic supply of tungsten back to North America. Its flagship IMA Mine Project sits in Idaho’s porphyry belt, largely on patented mining claims with road access, grid power, water rights, and a mining-oriented local workforce, key advantages when you want to move efficiently from rehab to output. Historic work by Bradley Mining, AMAX, and Inspiration (Anglo American subsidiary) advanced the project for decades; more recent campaigns by Gentor added another layer of drilling and geologic modeling.

The company also holds the Star Project (iron skarn) in B.C.’s Skeena Mining Division — 5 contiguous titles covering ~4,616 hectares near Prince Rupert, providing a second asset in a Tier-1 jurisdiction.

Why Now?

Critical metal, strategic urgency: Tungsten is classified as critical in both the U.S. and Canada, with China controlling roughly 84% of global supply. The November 2024 export ban only sharpened the urgency for domestic sources. Demand is growing across defense (armor-piercing munitions, missile bodies), aerospace, semiconductors, and energy technology.

Jurisdiction and logistics: Idaho is consistently rated among the most mining-friendly U.S. states. The IMA Mine benefits from patented claims, road and rail access, grid power, and water rights — factors that reduce permitting complexity, timelines, and capex risk.

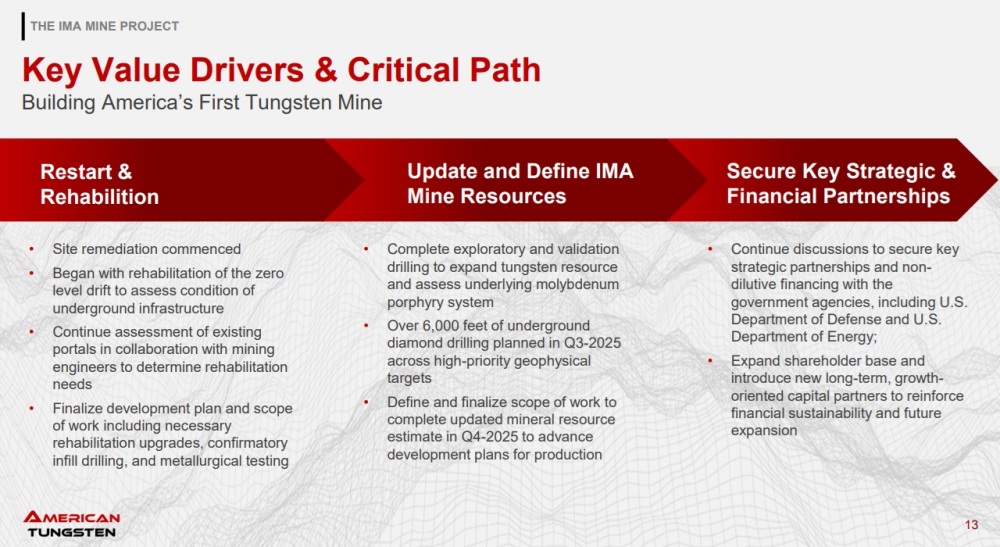

Near-term path and optionality: The restart plan centers on Direct Shipping Ore (DSO) at 500 tpd. DSO means the ore is rich enough to be mined, crushed, and shipped directly to a mill without a costly on-site plant. This approach keeps capex low (about US$20M vs. hundreds of millions for a full build), provides a faster path to cash flow, and lowers technical risk. Once cash flow is established, step-out drilling will target the molybdenum porphyry and southern vein extensions, with silver and moly credits offsetting operating costs. Ongoing discussions with U.S. agencies could also bring in non-dilutive funding.

Second asset: The Star Project in British Columbia adds portfolio depth in a Tier-1 jurisdiction.

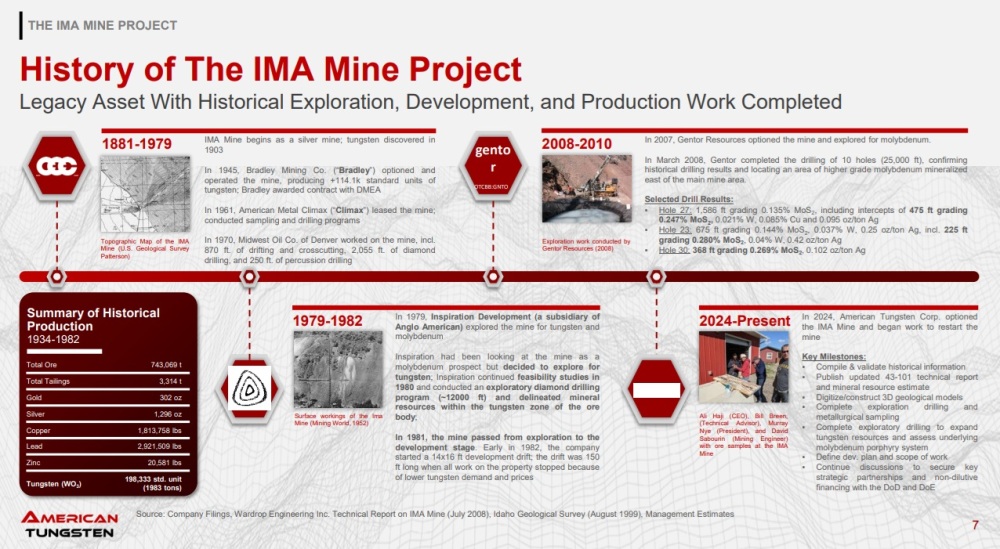

Past producer with scale and grade: The IMA Mine ranked among North America’s notable tungsten producers. Historical production records (1934–1982) list ~743k tonnes mined and 198,333 standard units of WO₃ (about 1,983 tonnes), plus payable silver, copper, lead, and zinc.

Patented ground, simpler path: Underground operations on patented claims are administered at the state level — no federal NEPA EIS anticipated, so the near-term plan focuses on a 500-tpd DSO start while confirmatory and step-out drilling build mine life.

Moly porphyry below the veins: Historic and Gentor drilling indicate a molybdenum system beneath the tungsten veins (with silver credits). Gentor’s 2008 work reported long MoS₂ intercepts east of the mine area, supporting the expansion case once near-term tungsten output is underway.

What’s being done now: Portal rehab of the “Zero” and “D” levels, road work, pads, and services are underway; the plan is limited to underground drilling to delineate short-term volumes, then step-outs targeting moly and additional WO₃ along strike and at depth.

“What’s Old is New Again”

1881–1970s: IMA starts as a silver mine; tungsten is recognized early and becomes the focus through the Bradley era (incl. a DMEA contract during the defense build-out).

1979–1982 (Inspiration/Anglo American): ~12,000 ft of drilling; development drift initiated before prices fell and work stopped.

2008–2010 (Gentor): ~25,000 ft drilled, confirming older results and outlining higher-grade Mo east of the main mine area.

Management

We see this management team as highly capable of advancing, building, and operating American Tungsten. The group is led by CEO Ali Haji (M&A and mine builds), President Murray Nye (U.S. underground mining), CFO Dennis Logan (ex-Almonty, tungsten sector finance), and VP Exploration Austin Zinsser (advanced Idaho projects from greenfield through to construction).

The bench also includes Jim Whittaker, COO of Capstone Copper and former President of BHP’s Escondida, bringing world-class operating expertise. Together, this is a seasoned group with the mining and financial depth to execute.

Share Capitalization

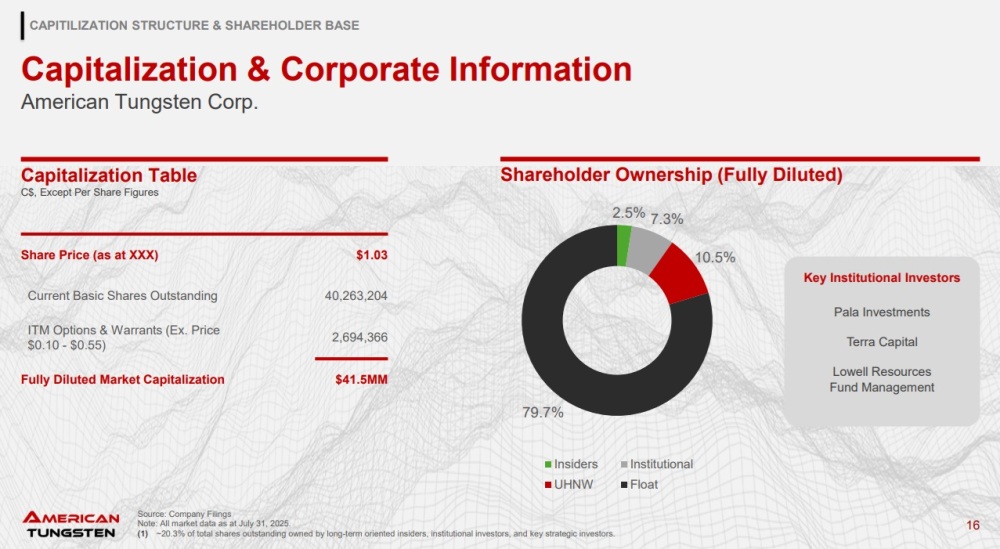

As of July 31, 2025: ~40.3M basic shares, ~2.7M ITM options / warrants, and a market cap near CA$41.5M.

Institutions and insiders control roughly 9.8% on a fully diluted basis, with more than 79% U.S. retail holders, a helpful base when a U.S. listing is pursued.

A July financing was upsized to ~CA$7M, providing runway for rehab, drilling, and the updated resource work.

Technical Analysis

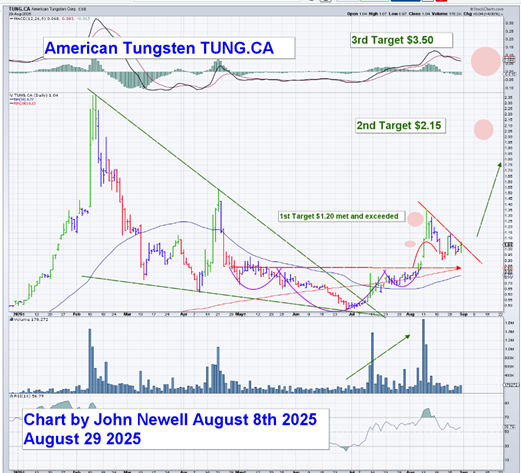

American Tungsten has been building a constructive technical base over the past few months after a sharp correction from its February highs. The stock recently broke out of a long downtrend, triggering a reversal pattern that has already met and exceeded the first upside target of CA$1.20.

The breakout was confirmed by higher trading volumes and improving relative strength, signaling renewed investor interest. After consolidating just above the breakout zone, the stock is now pressing against a short-term downtrend line. A close above this level would likely trigger the next leg higher.

- First Target (CA$1.20): Achieved and exceeded.

- Second Target (CA$2.15): A sustained move above resistance suggests this is the next logical area of supply.

- Third Target (CA$3.50): The bigger picture target if momentum continues, which would represent a full reversal of the earlier decline.

Momentum indicators, including the MACD, show the stock is poised for another upward move as long as it can hold above the CA$0.90–CA$1.00 support area. The recent price action also resembles a cup-and-handle formation, a bullish continuation pattern often associated with significant upside once confirmed.

Volume trends are also constructive. Accumulation days have outpaced distribution, which adds conviction to the bullish setup. The chart suggests that American Tungsten could continue to attract both technical and fundamental investors as it works through its next breakout zone.

American Tungsten is showing all the hallmarks of a junior resource stock transitioning from a basing phase into an advancing phase. With the first target already met, the chart points to CA$2.15 as the next milestone, with the potential to reach CA$3.50 on a bigger-picture move if market conditions remain supportive.

Conclusion

With tungsten prices strong and defense procurement in focus, American Tungsten offers a credible route to restart U.S. tungsten output on patented Idaho ground, with exploration torque beneath and beyond the historic veins. The setup checks my boxes technically and fundamentally. Therefore, we rate the shares a Speculative Buy.

To learn more at the company’s website: americantungstencorp.com.

American Tungsten Corp. (TUNG:CSE; TUNGF:OTCQB; RK9:FSE) closed for trading at CA$1.07, US$0.785 on September 8, 2025.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it’s advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.