On July 21, our newsletter introduced Argenta Silver Corp. (AGAG:TSX.V; AGAGF:OTCQB) as the next big silver story to grace Argentina.

Before we could even catch our breath, the company just dropped a monster set of drill results, including exceptionally high-grade hits such as 3,549 g/t Silver over 1.00 meter.

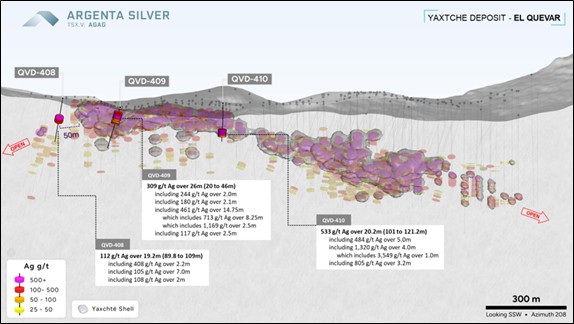

The standout hit comes from hole QVD-410, which intersected 20.20 meters grading 533 g/t silver. Within that, the team pulled out that scorching hot 1-metre hit grading 3,549 g/t silver.

For context, anything over 400 g/t silver is typically considered bonanza-grade nowadays. So, this result will surely turn heads, especially considering that this is only the program’s first hole.

Then there’s QVD-409, which returned a solid 309 g/t over 26 meters. That hole included a thicker run of 713 g/t over 8.25 meters, with a subinterval of 2.50 meters grading 1,169 g/t silver.

Both QVD-409 and QVD-410 are confirmation holes, corroborating broad high-grade silver intervals within the Yaxtché Deposit.

Even QVD-408, a step-out hole drilled a mere 50 meters southeast of the known resource, hit 112 g/t silver over 19.20 meters. This hole, along with the others, can be better envisaged below.

Taken together, these intercepts suggest that the original 45.3 Moz silver resource — already one of Argentina’s largest pure silver assets — may just be the tip of the iceberg for El Quevar.

And that’s before factoring in the 66,000 meters of historical core still left unassayed, where recent sampling returned up to 882 g/t silver over 1 meter, at almost no cost to the company.

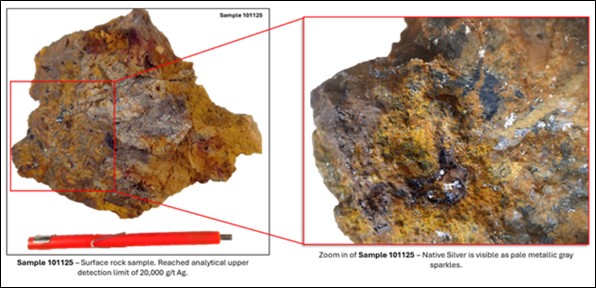

Better yet, surface sampling has delivered eye-popping numbers, with one grab sample coming in above the 20,000 g/t detection limit, and others grading high at 16,145 g/t and 6,004 g/t silver.

Of course, these surface results don’t define a resource. However, they certainly help highlight El Quevar’s extraordinary potential, which is reiterated by Argenta Silver CEO, Joaquin Marias:

“With assays returning 533 g/t Ag over 20.20 m in a drill intercept, a surface rock-chip sample topping 20,000 g/t Ag and legacy core that has been sampled for the first time returning positive high-grade silver results, we‘ve only just begun to unlock the true potential of this high‑grade silver system.”

What Does This Mean for Shareholders?

In short, the first drill results from Argenta’s fully funded 4,000-meter campaign are a textbook example of early-stage exploration success — the kind that puts a company firmly on the radar.

More importantly, they show that this isn’t a vanity re-listing or a tired retread. Instead, it’s a serious campaign backed by talented geologists, deep-pocketed investors, and a top-tier asset.

Therefore, when considering that just 3% of the property has seen modern exploration so far, we believe July 21st hits are only the start of a generational silver system in the heart of Argentina.

And with assays for the remaining holes due by mid-August and mid-September, this Argentine dynamo has all the catalysts it needs to blow the market’s socks off in the coming months.

The Stock

Argenta shares were already up 12% on July 21, following the release of these blockbuster results. With just the first few holes in and much of the system left to test, there’s plenty more news flow to come.

Naturally, I remain full weight in AGAG and look forward to seeing how this talented management team executes on its strategy going forward.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |