NatBridge Resources Ltd. (GEGC:CSE; GEGCF:OTC; GI8:FRA), which was renamed on June 19 from Great Eagle Gold Corp. (GEGC:CSE; GEGCF:OTC; GI8:FRA), is in the vanguard of a movement that is set to revolutionize the gold mining industry.

NatBridge Resources is at the forefront of the ESG shift from traditional gold mining to digital gold mining. Traditional gold mining involves getting gold out of the ground, an expensive, laborious, and time-consuming business, and then a large percentage of the gold that is excavated goes back into the ground as gold bars in bullion vaults.

What NatBridge Resources will be doing is revolutionary because it will acquire and prepare NI 43-101 compliant underground gold deposits for tokenization into NatGold coins — so that the gold in the ground is ascribed value and ownership without ever having to be mined. It is understood that this will be a difficult concept for some older and more traditional investors to grasp, who may feel that “If you can’t hold it in your hand, it’s not real.” However, this tokenization of the gold in the ground is probably more real than Bitcoin, and as we know, Bitcoin has become mainstream, so why not digital gold?

We will now examine how this works using pages from the company’s latest investor deck.

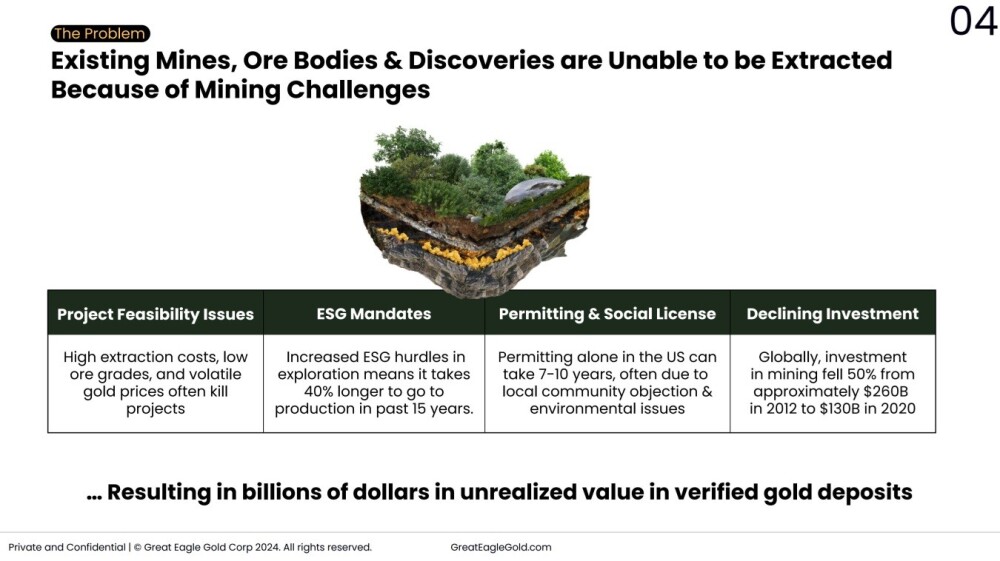

The problems facing the traditional gold mining industry are set out by this image:

While it can be argued that these problems are less formidable because of the strongly rising gold prices, it also means that the NatGold tokens are becoming correspondingly more valuable.

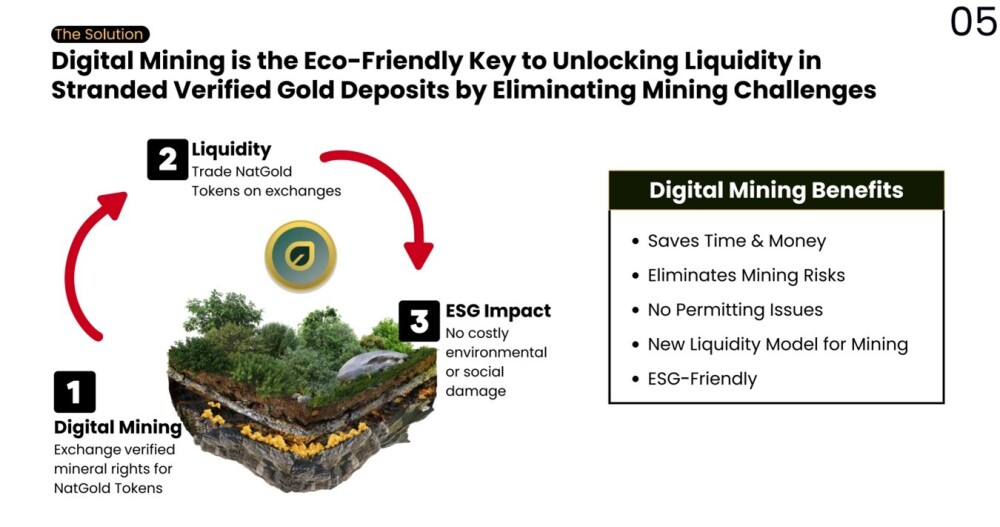

The solution is digital mining — while this clearly doesn’t work in the case of gold jewelery what it means is that gold resources in the ground can quickly acquire value — instead of sitting in bank vaults in the form of gold bars it stays in the ground in its raw state but is assigned value thus obviating the need to dig it up and refine it at great cost.

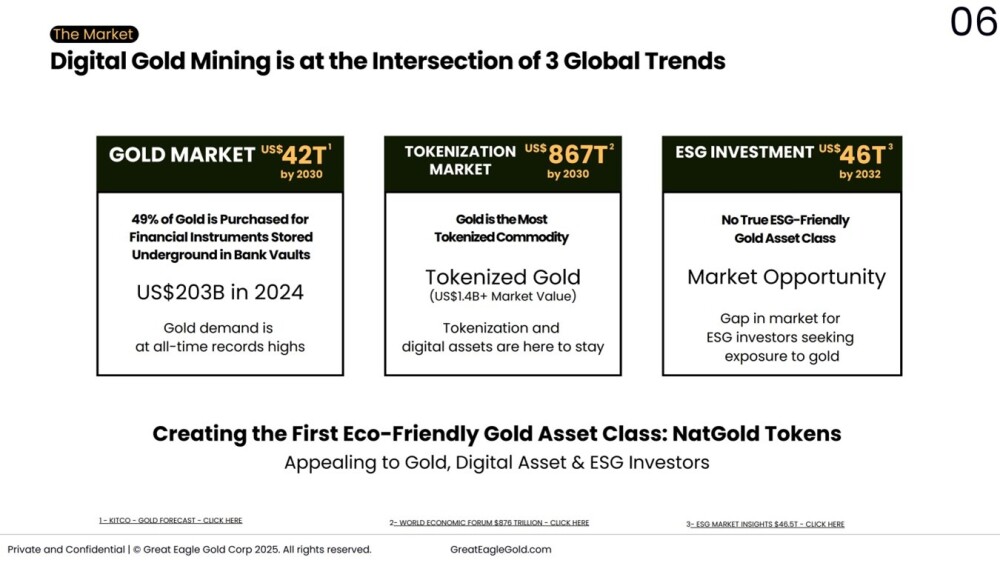

Digital Gold Mining is at the intersection of three rapidly accelerating global trends, with gold demand expanding rapidly, huge growth in the still-young tokenization market, and the rising appeal of ESG investments.

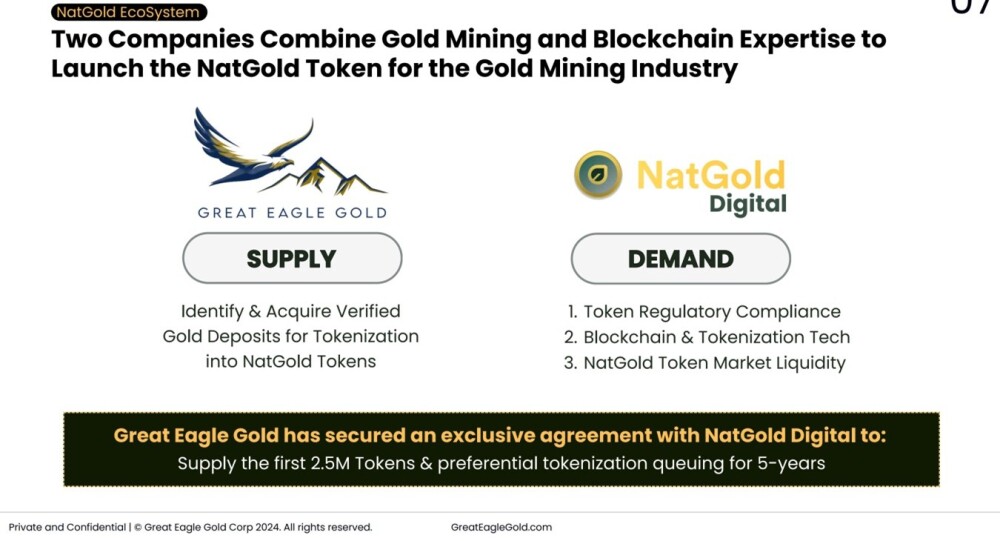

NatBridge Resources is in close partnership with NatGold Digital, with NatBridge Resources covering the supply side by identifying and verifying gold targets for tokenization, while NatGold Digital provides Blockchain and Tokenization expertise, thus covering the demand side.

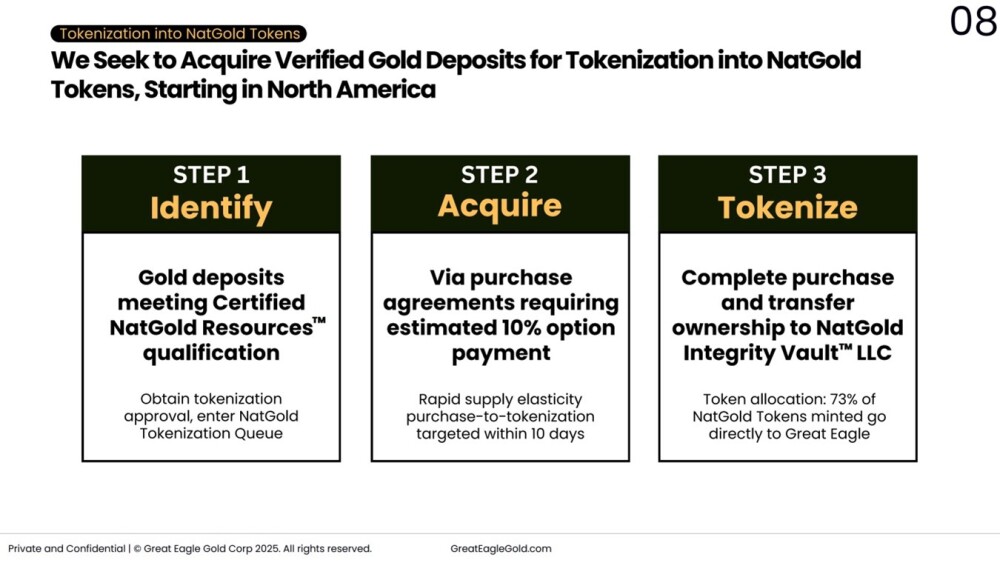

Here is how the process works, starting in North America:

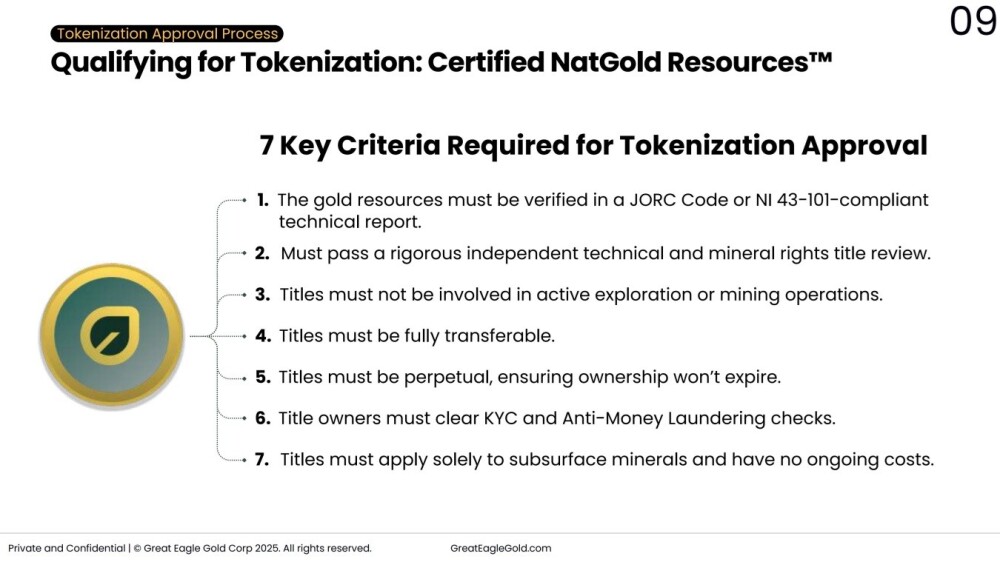

This image sets out the tokenization approval process, in which seven conditions have to be met:

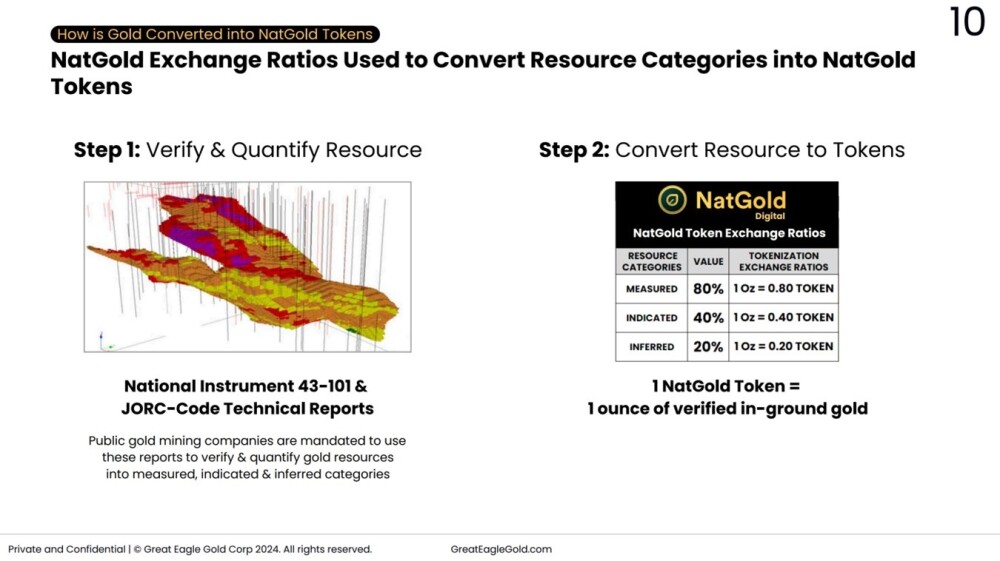

These are the exchange ratios used to convert resources into NatGold tokens based on whether they are Measured Indicated or Inferred:

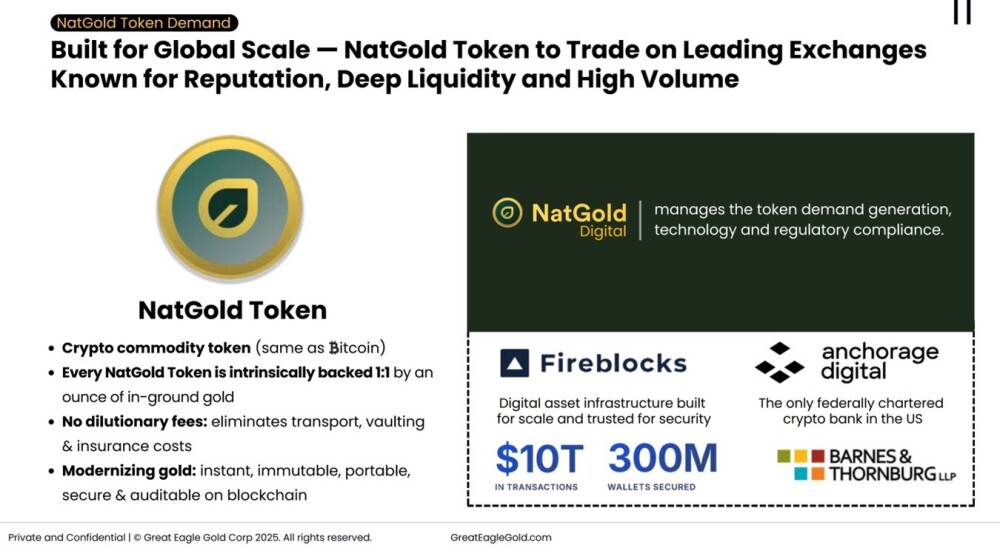

NatGold Tokens will have global appeal and trade on leading exchanges, and, being on the Blockchain, will be free of the costs and fractional losses associated with traditional bullion.

NatGold Digital forecasts that 17.5 million tokens will be issued in the first three years, with 2.5 million in the first year, 5 million in the second year, and 10 million in the third year.

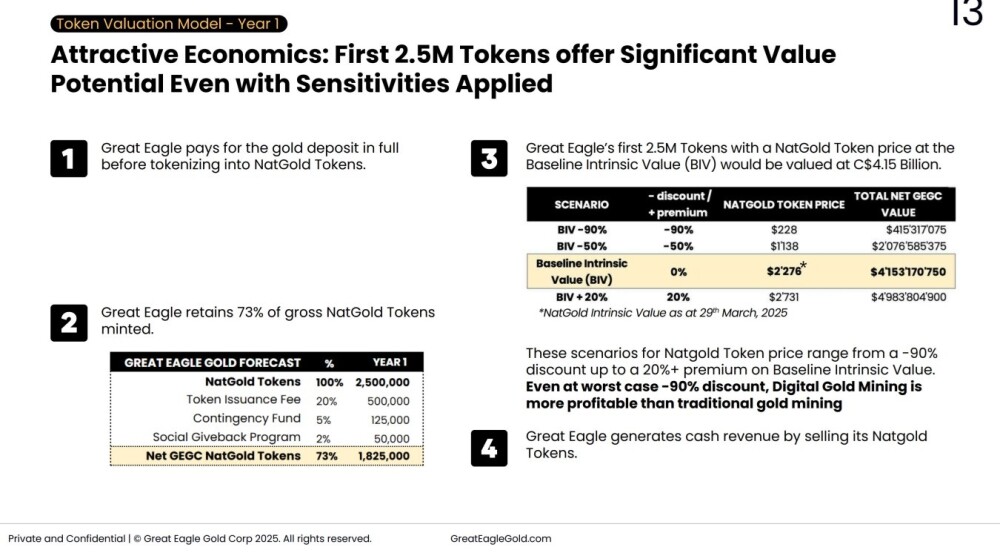

The next page sets out the Token Valuation Model for year one. Two key points to note are that NatBridge Resources generates cash revenue by selling its NatGold tokens and that even in a worst-case scenario of a 90% discount, digital gold mining would be more profitable than traditional gold mining.

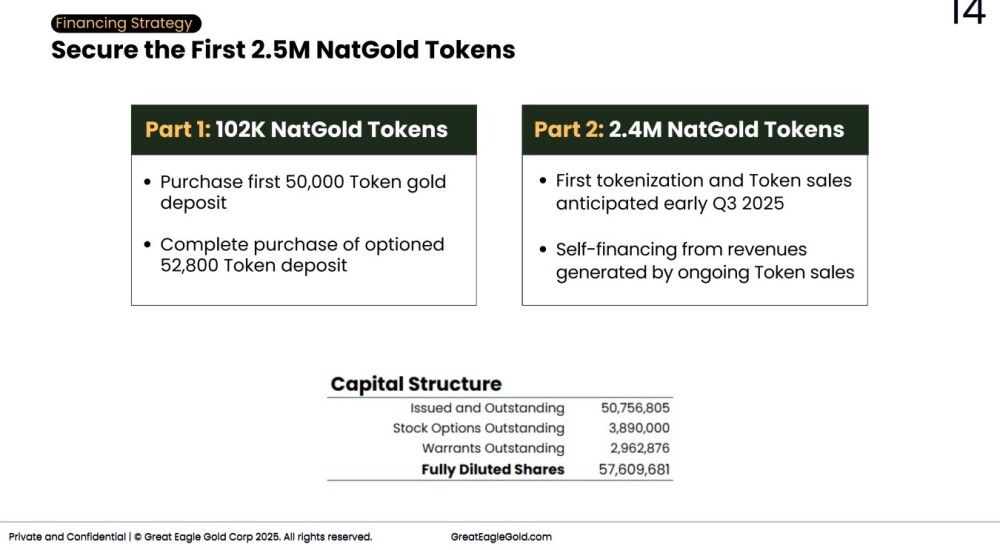

Financing Strategy: key points to note here are that NatGold anticipates the first tokenization and token sales in the third quarter of this year, and that the company will be self-financing from the revenue generated by ongoing token sales, and that there are 50.7 million issued and outstanding shares.

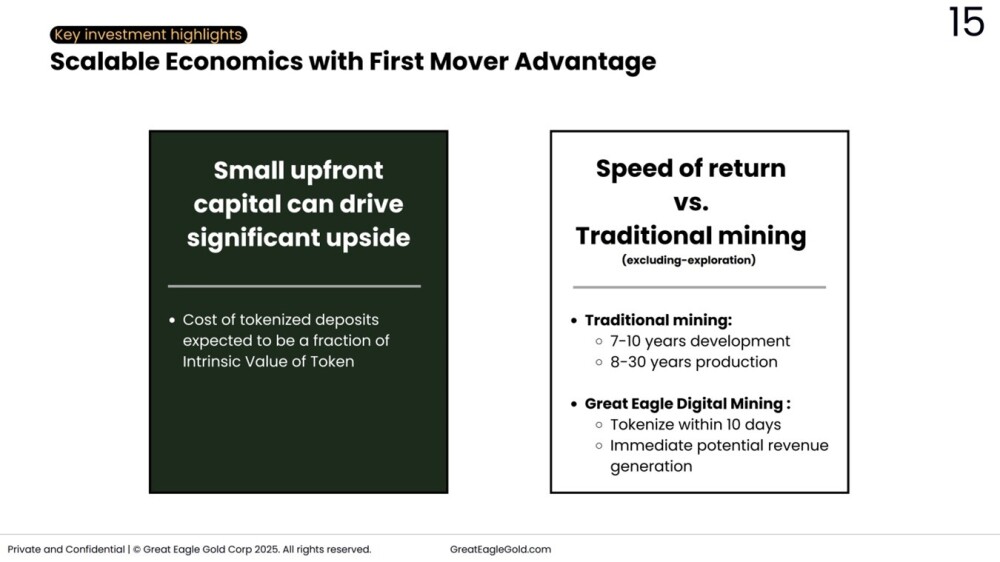

The speed of revenue generation compared to traditional mining is simply astounding — it’s like comparing a tortoise to the Starship Enterprise.

This is because of the advantages conferred by tokenization and the blockchain.

Now, we turn to consider the charts for NatBridge Resources — renamed on June 19 from Great Eagle Gold — where it quickly becomes clear why the stock looks so attractive here.

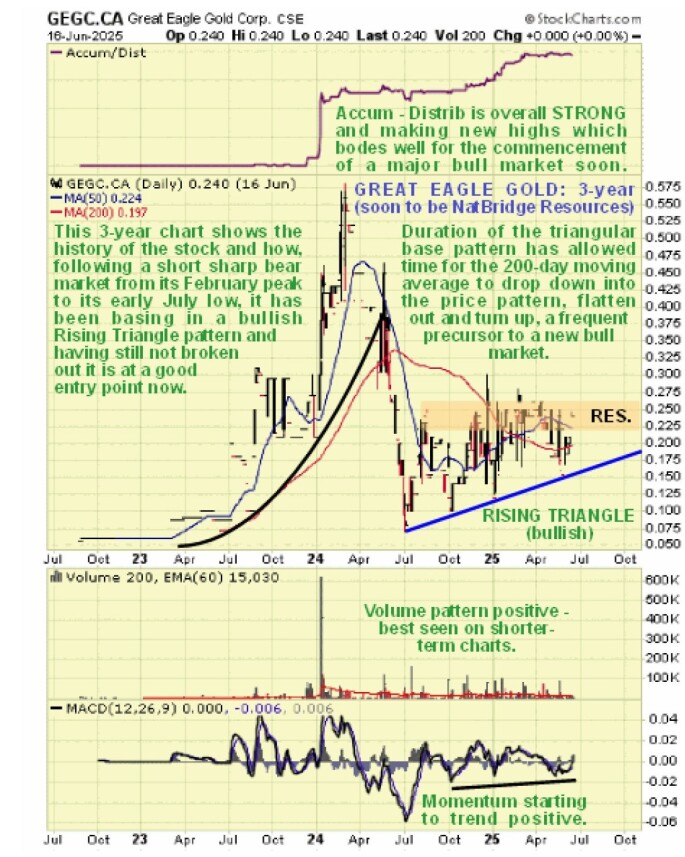

Although NatBridge Resources has appreciated some since we last looked at it back in January, it has yet to break out of the large basing Triangle that started to form over a year ago, as we can see on the latest 3-year chart below.

This Triangle developed following a severe bear market that saw the price break down from a parabolic blowoff move and plunge steeply lower from about CA$0.58 at its peak to close to CA$0.07.

After hitting bottom, the price gradually crept higher within the confines of the bullish Rising Triangle shown with the positive volume pattern and strong Accumulation line promising an eventual upside breakout above the resistance marking the upper boundary of the Triangle.

On the 1-year chart, we can view the basing Triangle in much more detail and see how there is an array of bullish factors pointing to an upside breakout soon from this pattern. The positive volume pattern with a preponderance of upside volume is much easier to see on this chart.

The Accumulation line has been and remains strong, not dropping back on the recent price reaction from early April, another positive sign. In addition, we can see a trend of higher lows for almost a year now with the duration of the pattern allowing time for the 200-day moving average to drop down into the price zone, flatten out and turn up, so that the price and its moving averages are bunching with the latter swinging into bullish alignment, setting the stage for an upside breakout before long above the resistance at the top of the Triangle.

With the rising lower boundary of the Triangle shepherding the price towards an upside breakout into a new bull market soon, and strong volume indicators pointing to this outcome, NatBridge Resources is rated an Immediate Strong Buy.

The first target for an advance is the resistance in the CA$0.44 – CA$0.46 zone. The second target is the early 2024 high at about CA$0.58, and it is likely to ascend beyond this to higher levels.

Great Eagle Gold’s current website.

NatBridge Resources Ltd (formerly Great Eagle Gold), NATB on CSX (will be GEGC until close of trading on June 22), closed for trading at CA$0.25, US$0.161 on June 19, 2025.

| Want to be the first to know about interesting Special Situations, Gold and Technology investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.